Vivian Tu Review: Wall Street Wizard or Just Your Rich BFF With a Ring Light?

- FinanceInfluencer Reviews

- May 17, 2025

If you’ve ever doomscrolled TikTok at 1am and found yourself learning about Roth IRAs instead of watching dog videos, you’ve probably seen Vivian Tu, better known as @YourRichBFF.

A former Wall Street trader turned finance influencer, Vivian has taken the internet by storm with her punchy, easy-to-digest financial advice delivered while wearing a great outfit and sipping an oat milk latte.

But with millions of followers, a best-selling book, and a brand built on money smarts… is she actually helping people? Or is this just another finance influencer riding the content creator gravy train?

Let’s dig in.

Who Is Vivian Tu Review?

Vivian Tu is a former equities trader at J.P. Morgan, a self-proclaimed “ex-Wall Street girly,” and now one of the most followed financial creators online. After leaving banking, she worked at BuzzFeed in sales, where coworkers kept asking her for money advice.

So what did she do?

She did what all viral legends do—she started a TikTok account.

And within a year, she’d built Your Rich BFF, a brand focused on financial literacy, empowerment, and breaking down confusing money topics for young people, especially women and marginalized groups.

As of today, she’s got:

-

3.5M+ followers on TikTok

-

A thriving Instagram and YouTube presence

-

A New York Times Bestselling Book

-

A podcast, brand deals, and… merch. Obviously.

What Products & Programs Does Vivian Tu Offer?

Vivian doesn’t just give free advice—she’s also built a growing empire of paid content, books, sponsorships, and financial education tools.

Let’s break them down:

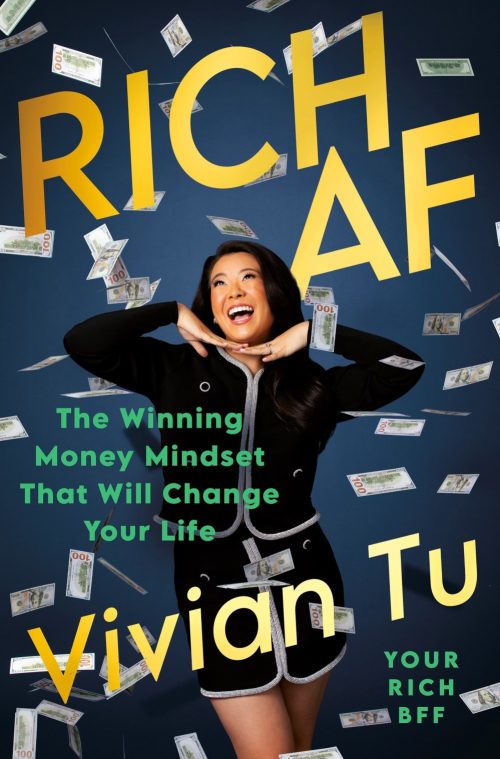

1. Rich AF: The Winning Money Mindset That Will Change Your Life

This is her flagship product: a book that went straight to the New York Times Bestseller list.

What’s inside?

-

How to master the financial system without hating your life

-

Real-world money strategies explained in plain English

-

Tips for investing, saving, budgeting, credit cards, and even taxes

-

Plus: relatable stories, a bit of sass, and no Wall Street jargon

If you’re searching for a legit Rich AF book review, here’s the summary:

It’s not a technical guide, but it is a mindset-shifting, Gen-Z-friendly intro to personal finance. You’ll learn, laugh, and probably side-eye your credit card habits.

Price: ~$28

Verdict: Great for beginners, especially if you want the truth about money without feeling like you’re reading a textbook wrapped in a TED Talk.

2. Networth and Chill Podcast

Vivian’s podcast dives deeper into the real-life applications of personal finance.

Topics include:

-

“Should you split bills 50/50 in a relationship?”

-

“Why you’re still broke even with a $100k salary”

-

“How credit card companies actually make money off you”

Guests range from tax experts to dating coaches (yes, money affects that too), and the episodes mix education with just enough tea to keep it spicy.

Great for:

People who want to absorb money knowledge without watching 10-minute TikToks or being yelled at by finance bros in hoodies.

3. Sponsorships, Brand Deals & Merch

Vivian’s built a monetized platform that includes:

-

Sponsored posts (from brands like NerdWallet and Chime)

-

Affiliate links to legit financial tools

-

Merch and resources for her audience

Does that mean she’s a sellout?

Nope. It means she turned her expertise into a business model—something we should expect from someone giving financial advice.

Vivian Tu Reviews: What Real People Say

Let’s be real. You can’t grow a platform this fast without ruffling a few credit-score-shaped feathers.

Here’s the breakdown of Vivian Tu reviews across the web:

👍 Positive Reviews

-

Accessible language: People love that she explains financial concepts like a best friend—not a CFP robot with Excel open.

-

Representation matters: Vivian resonates with young women, POC, and first-gen wealth builders who feel excluded from the “old guard” of finance advice.

-

Actionable advice: She gives clear takeaways, not just fluff or inspirational quotes about compound interest.

“Vivian helped me actually understand my 401k for the first time. My HR department couldn’t even do that.” — Reddit user

👎 Negative Reviews

-

“Not deep enough”: Some advanced users feel her content is too basic. But let’s be honest—TikTok isn’t built for 45-minute deep dives into tax-loss harvesting.

-

“She’s not a CFP”: True—Vivian isn’t a certified financial planner, and she doesn’t pretend to be. Critics say she should disclose that more, though she’s clear in her disclaimers.

-

“Vivian Tu scam” searches exist: Usually by folks who didn’t realize TikTok advice should be paired with actual action… and maybe a spreadsheet or two.

Is Vivian Tu a Scam?

Let’s address the big SEO magnet here.

Is Vivian Tu a scam?

Short answer: Absolutely not.

She:

-

Built her brand with real experience (Wall Street + Buzzfeed sales = rare combo)

-

Discloses partnerships

-

Offers tons of free education

-

Doesn’t push “get rich quick” BS or promote shady crypto nonsense

That said…

🚩 If you’re expecting her to magically fix your debt overnight with one 60-second video? You’re gonna be disappointed.

🚩 If you think a bestselling book will replace actual financial discipline? Yeah… no.

Vivian gives you the tools—but you’ve still gotta pick them up and use them.

Final Verdict: Is Vivian Tu Worth Following?

Here’s the no-BS breakdown:

✅ If you’re in your 20s or 30s, trying to get your money right without falling asleep watching Dave Ramsey…

✅ If you want finance explained with pop culture references and a good outfit…

✅ If you’d rather learn about 401(k)s while sipping boba than reading a textbook…

Vivian Tu is your girl.

But if you:

❌ Already have a full investment portfolio

❌ Want hyper-detailed financial spreadsheets

❌ Think memes don’t belong in finance

…you may want to stick to The Wall Street Journal and let the rest of us have fun learning.

Want to Build Wealth Without the Wall Street Jargon?

If Vivian Tu helped you understand your money…

But you’re still wondering how to actually grow it long-term?

Check out Prime DeFi with Dan Ryder — a program built for beginners to earn 60% to 200% returns per year through smart, safe decentralized finance strategies.

✅ No TikTok hype

✅ No scammy affiliate offers

✅ Just real income strategies used by 3,000+ students

👉 Click here to access the FREE training

Because financial literacy is step one. Wealth-building is step two.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level.