Ravexis Review – “Visionary Innovation” Meets 6% Daily Reality Check

- Uncategorized

- January 20, 2026

If you’ve been in crypto long enough, you start to recognize patterns.

Not charts.

Not indicators.

Website patterns.

And Ravexis?

Ravexis is running a very familiar playbook.

On the surface, it wants to look like a polished venture capital firm backing world-changing startups, clean energy, biotech breakthroughs, and “visionary founders.”

Scroll just a little further though…

And suddenly it’s offering 6% to 7% daily returns with real-time withdrawals and a $10 minimum deposit.

That’s when the record scratches.

Because legitimate venture capital firms do not operate like HYIPs.

And HYIPs love pretending they’re venture capital firms.

Let’s break this down properly.

Now before I dive in do you want a FREE Training by my good friend DAN on how you can pull in 3% to 10% per month on a powerful yet simple crypto cash flow strategy?

WATCH THAT RIGHT HERE AND START WINNING

Proof this works:

WATCH THAT RIGHT HERE AND START WINNING

You never have to worry about being exit scammed on ever again!

Let’s dig in.

Who Runs Ravexis Review?

According to the website, Ravexis is led by a very professional-looking team:

- Ethan Cole – Founder & Managing Partner

- Sofia Alvarez – Head of Research & Insights

- Alex Pereira – Partner, Technology Investor

Strong names.

Clean headshots.

Impressive titles.

There’s just one small problem.

There is no verifiable digital footprint connecting these people to Ravexis outside of this website.

No LinkedIn confirmations.

No press mentions.

No investment history.

No public filings.

In real venture capital, partners leave trails — portfolios, exits, interviews, failures, wins.

Here?

The team exists only where the deposits exist.

That’s not leadership.

That’s decoration.

What Ravexis Claims to Be

Ravexis positions itself as a high-level investment partner focused on:

- Emerging technologies

- Health & biotechnology

- Financial innovation

- Smart infrastructure

- Clean energy

The language is intentionally vague but emotionally powerful.

“Impact.”

“Vision.”

“Global change.”

“Partnering with founders.”

It sounds like a pitch deck someone watched once… then recreated from memory.

Now here’s the key question:

If Ravexis were truly backing early-stage startups, biotech research, and infrastructure projects…

Why are they offering fixed daily returns to anonymous online users?

That alone breaks the illusion.

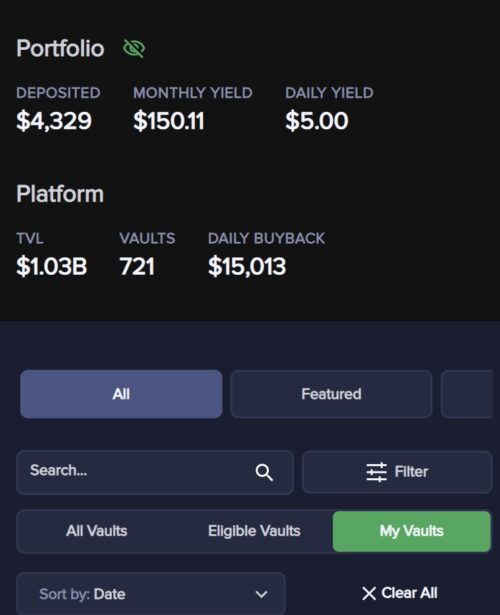

The Investment Plans (Where the Mask Slips)

Here’s where Ravexis stops pretending to be a VC firm and starts acting like what it really is.

Ravexis Basic

- 6% daily

- $10 minimum

- 25 days

- Real-time withdrawals

- Referral: 5% – 2%

Ravexis Elite

- 7% daily

- $200 minimum

- 20 days

- Real-time withdrawals

- Referral: 5% – 2%

Let’s be clear:

No venture fund.

No private equity firm.

No biotech accelerator.

No clean energy syndicate.

…pays 6% to 7% per day.

That’s not innovation.

That’s arithmetic abuse.

The Domain Tells a Story Too

Ravexis.top was registered on January 16, 2026.

That means:

- Brand new domain

- Zero operating history

- No long-term reputation

- No legacy capital

Yet somehow Ravexis already claims:

- Global impact

- Case studies

- Multiple sectors

- Visionary founders

- Scalable innovation

That timeline doesn’t add up.

Real investment firms take years to build credibility.

HYIPs build it in weeks.

The Case Studies (Marketing Fiction 101)

Ravexis showcases impressive-sounding case studies:

- Biogenera Health

- Tesla Core Village

- Sustainable infrastructure projects

- Longevity innovation

Notice something?

There are:

- No verifiable company registrations

- No funding announcements

- No third-party coverage

- No press releases

- No external validation

These are story props, not portfolio companies.

HYIPs don’t sell data.

They sell confidence.

The AI / Innovation Buzzword Soup

Ravexis uses a beautiful combination of:

- Innovation

- Technology

- Science

- Smart infrastructure

- Financial “incantational” systems (yes, really)

But provides:

- No technical documentation

- No audited financials

- No proof of revenue generation

- No explanation of capital flow

In legitimate investing, complexity is explained.

In scams, complexity is used to avoid explanation.

Affiliate Program (Quiet but Telling)

Ravexis offers a two-tier referral structure:

- 5% level one

- 2% level two

Not huge.

Not aggressive.

And that’s intentional.

This isn’t designed to explode fast.

It’s designed to look professional and last longer.

Low referral rates reduce scrutiny while still fueling new deposits.

Classic slow-burn HYIP strategy.

Withdrawals: Yes, They’ll Likely Pay (At First)

Let’s address the obvious question.

“Are people getting paid?”

Early on — yes.

They almost always are.

That’s how platforms like Ravexis:

- Build trust

- Encourage reinvestment

- Attract larger deposits

- Stretch timelines

Paying early users is not proof of legitimacy.

It’s proof of liquidity.

The Biggest Red Flag: Fixed Daily Profits

Ravexis claims:

- Daily fixed profits

- Real-time withdrawals

- No downside risk

- Short cycles

That combination cannot exist in real markets.

Real investing involves:

- Drawdowns

- Volatility

- Variability

- Risk disclosure

Fixed daily profit models only work when:

- New money funds old money

- Withdrawals stay manageable

- Growth eventually slows

And when it does?

The rules change.

Pros and Cons (Straight Talk)

Pros

- Very polished design

- Strong storytelling

- Low entry barrier

- Early payouts likely work

- Clean UI and onboarding

Cons

- Anonymous operators

- Fictional leadership profiles

- Impossible daily ROI claims

- No transparency on capital use

- No regulatory oversight

- New domain with no history

Final Verdict: Is Ravexis Legit or a Scam?

Ravexis is not a venture capital firm.

It is not an innovation fund.

It is not a biotech accelerator.

It is a high-yield investment program wearing a venture-capital costume.

A well-designed one.

A patient one.

A convincing one.

But the math always wins.

Final Thought

Ravexis doesn’t fail because it looks bad.

It fails because it looks too good.

When a platform promises vision, innovation, impact and fixed daily profits…

One of those things isn’t real.

And it’s never the profits.

Tired of Scams? My #1 Recommendation

If you landed on this blog, you want to actually know how to make money online right? Specially with crypto.

First time ever we are offering a training where we are helping our students who are getting any where between 3% to 10% per MONTH ROI on their crypto with 100% complete control.

YOU control everything and not giving your funds away to some scamming company.

Once you learn this skill set, the sky is the limit when it comes to building wealth with crypto where you are in 100% control.

Here are some more results:

This student literally got started a few days ago and already started to make $5 per day!

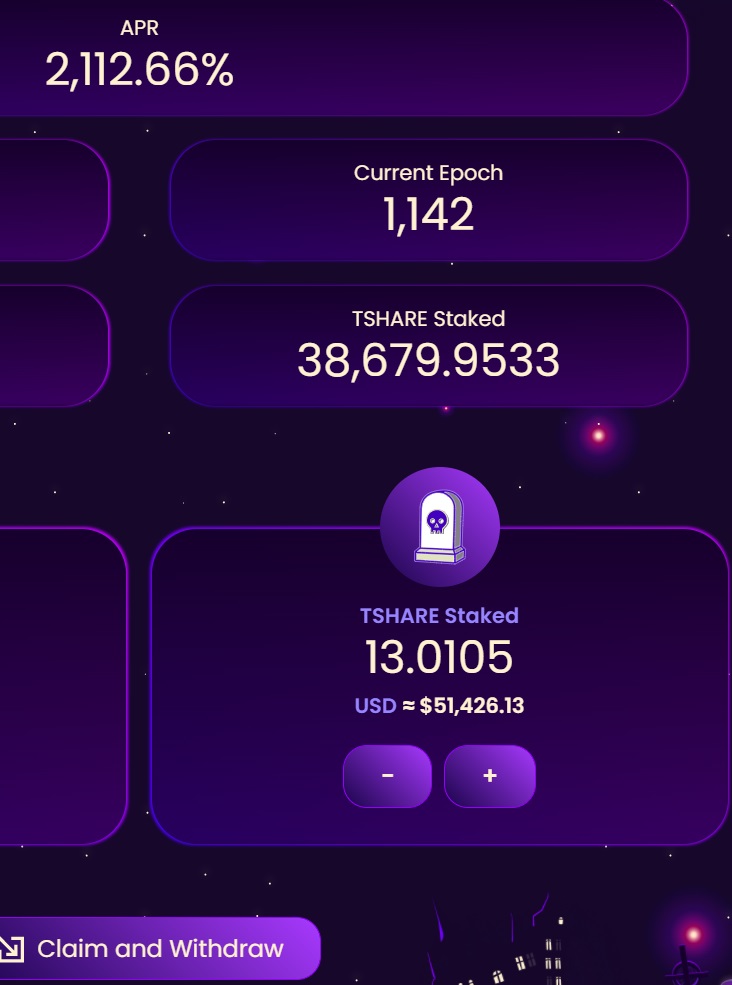

We are getting over 2000% rewards with this one per year which is LIFE changing.

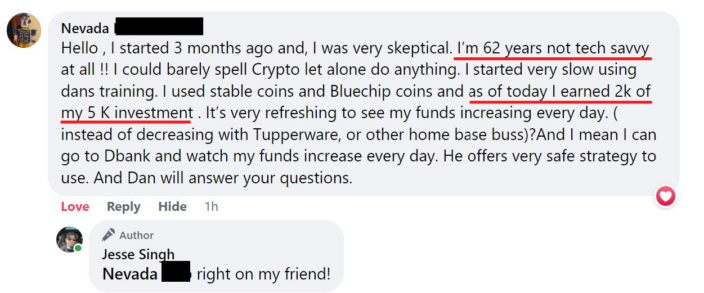

Take a look at one of our 62 year old students who profited $2,000:

Now we want to help YOU.

We have complete newbies who are just getting started and making their passive income stream online and then we have some students who have been with us for almost a year completely crushing it.

Digital Digital Economy is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Real Estate is for you.

I know you will make the right decision.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level