Credit Stacking Review – SCAM or Legit Jack McColl Course?

- Course Program Reviews

- September 29, 2023

Welcome to my Credit Stacking Review!

Jack McColl outlines four primary methods for obtaining business funding, each with its pros and cons. His preferred method involves acquiring zero-percent interest business credit—a strategy he coined as “Credit Stacking”. With numerous opinions circulating online, some might stumble upon a “Credit Stacking scam” review, but we’ll delve deeper to understand the inner workings and legitimacy of this strategy.

Now before I dive in, if you want to learn how I went from being an over worked car mechanic to building a 7 figure business online, this message is for you:

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

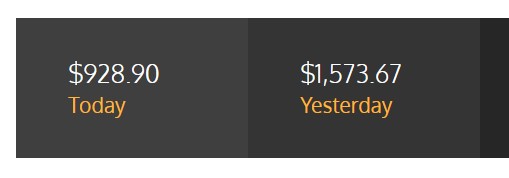

Just take a look at this:

Now I can’t guarantee you results like this but I am just showing you what is possible!

If that sounds like something you’d be interested in, check out Digital Real Estate.

Now if you want to continue, keep reading…

What is Credit Stacking Review?

Credit Stacking is a strategy developed by Jack McColl that emphasizes the importance of utilizing business credit with zero interest, enabling entrepreneurs to start or extensively grow their businesses. This strategy is fundamentally built on mastering one’s credit file and score, understanding the bank’s undisclosed approval criteria, and leveraging these to access significant zero-percent credit lines.

Who Runs Credit Stacking?

Credit Stacking is spearheaded by Jack McColl. He used this innovative approach to transition from having average credit and no business cards to securing three hundred thousand dollars in credit within a year. Jack’s extensive experience and success with this strategy have made it a sought-after solution for many aspiring entrepreneurs looking to break free from the conventional, often debt-inducing, funding methods.

How Does Credit Stacking Work?

Credit Stacking involves a three-step process. The first step revolves around gaining insight into your credit file and score. It’s crucial to be aware of your standing and the necessary steps to optimize it. The second step is about understanding and meeting the bank’s secret approval criteria to get approved for zero-percent cards. According to Jack, banks prefer clients to opt for high-interest options to profit from the interest payments.

The final step is implementing Credit Stacking to accumulate zero-percent interest money, akin to assembling pieces in a game of Tetris, matching the bureau and bank seamlessly. An inquiry sweep is also vital, clearing the history of applying to numerous business credit cards to avoid suspicion.

Cost To Join Credit Stacking Reviews:

While the article did not mention the exact cost to enroll in Credit Stacking, potential participants can book a call with Jack’s team to gather more information and discuss the specifics related to joining. It’s crucial for interested individuals to do their due diligence and read various Credit Stacking reviews to make informed decisions.

Final Verdict – Is Credit Stacking Legit or a Scam?

Jack McColl’s Credit Stacking strategy presents an alternative funding method for entrepreneurs seeking to avoid high-interest business loans or giving up equity. While some may be skeptical and think of it as a Credit Stacking scam, many have found success and managed to acquire substantial credit limits without fees or interest using this approach.

However, getting approval isn’t straightforward, leaving the average real estate investor and small business owner resorting to traditional funding methods, sometimes resulting in crippling debt and bankruptcy. Jack emphasizes that this occurrence is a tragedy, stating that this isn’t how business operations should unfold.

To genuinely assess whether Credit Stacking is a viable solution, prospective users should examine various Credit Stacking reviews and perhaps have a direct conversation with the Credit Stacking team. It’s always wise to explore all possible options and gather enough information before making any financial commitments or decisions.

My Number 1 Recommendation

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

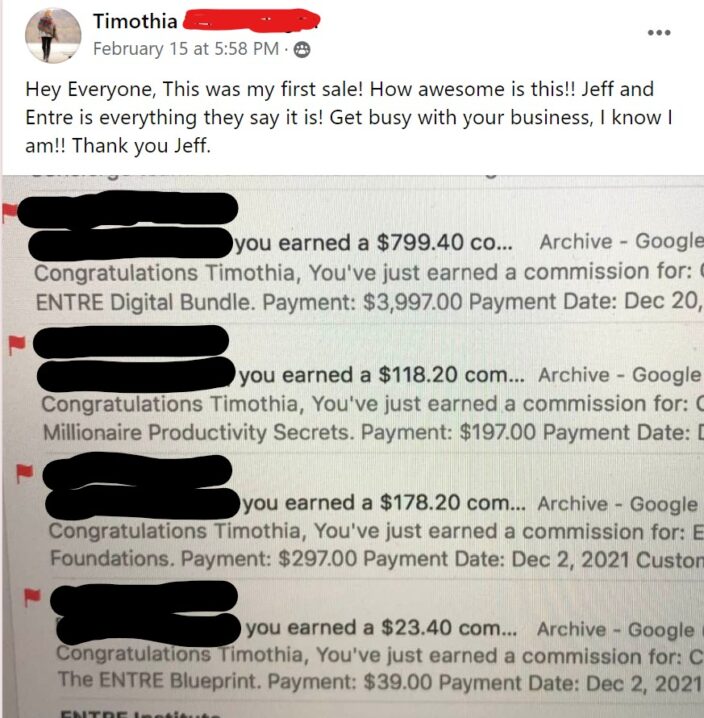

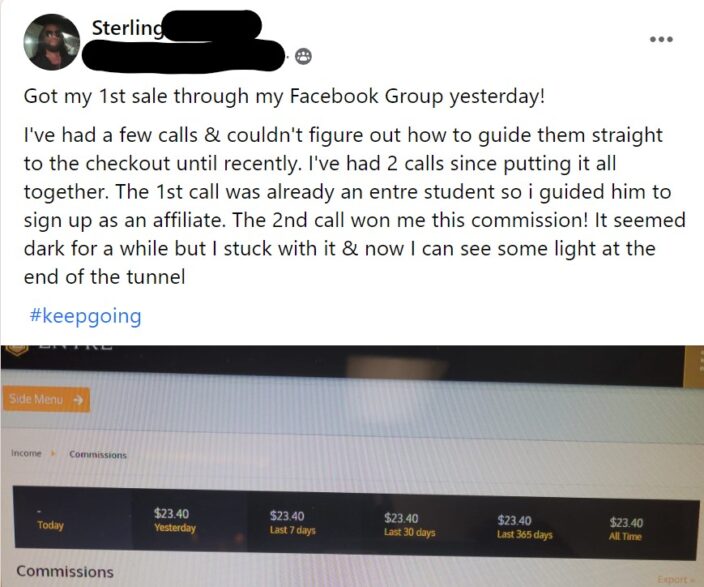

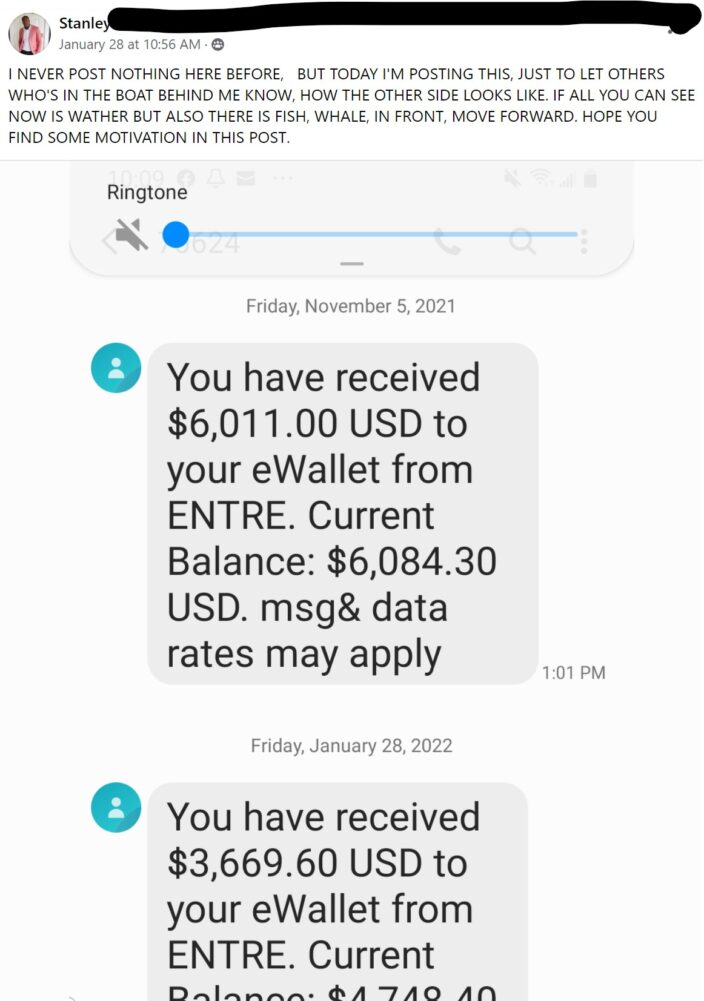

Take a look at some of the results:

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

If that sounds like something you’d be interested in, check out Digital Real Estate.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level.