Marsses Review: Legit 0.48-0.88% ROI Daily or SCAM?

- Crypto MLM Reviews

- December 20, 2025

If you’ve been in crypto longer than five minutes, you’ve seen this movie.

It starts with a slick website, a bunch of “enterprise” buzzwords, and numbers so big they look like they were typed by a guy who thinks commas add credibility.

Then they hit you with the magic spell:

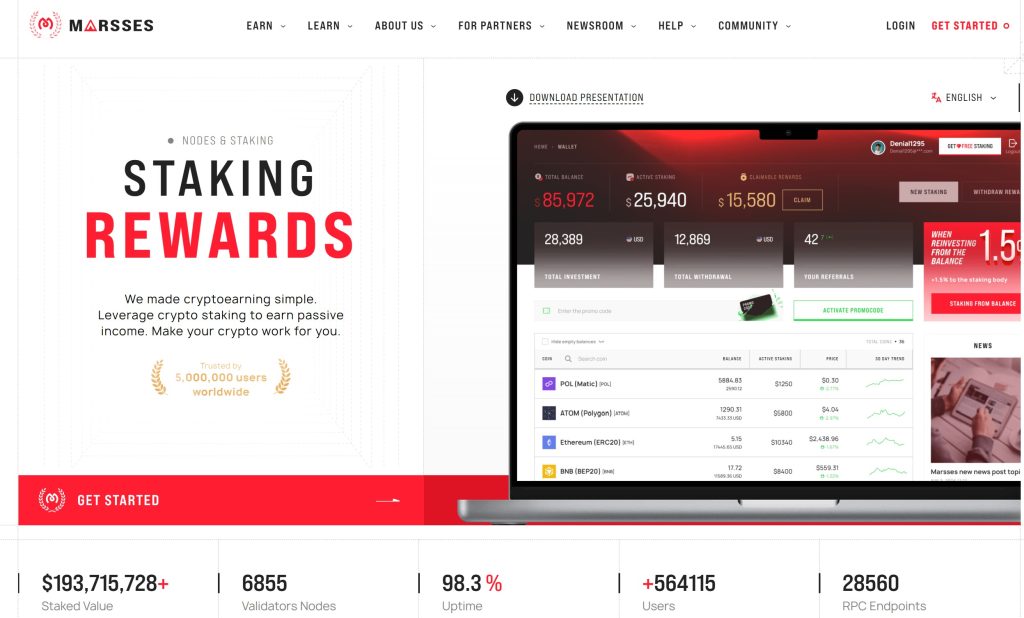

“Stake your crypto. Earn passive income. Full custody. No smart contract exposure. Multi-layer security. 98.8% uptime. Trusted by 5,000,000 users worldwide.”

Cool. So basically… the Avengers of staking platforms.

But here’s the problem: when you peel back the glossy marketing, Marsses looks less like a serious staking operation and more like one of those “we’re totally real, trust us bro” sites that can’t keep its own story straight.

So in this Marsses Review, we’re going to break down what Marsses claims, what’s actually on the site, and the parts that should make any sane person pause before sending them a penny.

Now before I dive in do you want a FREE Training on how you can pull in 3% to 10% per month on a powerful yet simple crypto cash flow strategy?

WATCH THAT RIGHT HERE AND START WINNING

You never have to worry about being exit scammed on ever again!

Let’s dig in.

Marsses Introduction

Let me tell you a quick story.

Imagine you walk into a dealership and the salesman says:

“This car is trusted by 5 million drivers worldwide… it gets 250% APR… the engine is powered by AI… and if you bring your friends, we’ll pay you 10% of whatever they finance.”

You’d be like… “Nice pitch. Where’s the VIN? Who owns this dealership? Why is the salesperson’s name ‘Ethan Walker’ and his social accounts are either brand new or banned?”

That’s the exact vibe Marsses gives off.

Because Marsses isn’t just selling staking. It’s selling a dream scenario:

- Big daily ROI ranges

- Massive “staked value” numbers

- A deep list of “leadership”

- A long “affiliate rank ladder”

- And a bunch of technical words designed to make you feel dumb for asking normal questions

The problem is: real companies don’t need to hypnotize you with numbers and costumes. They can prove it.

So let’s get into it.

Who Runs Marsses Review?

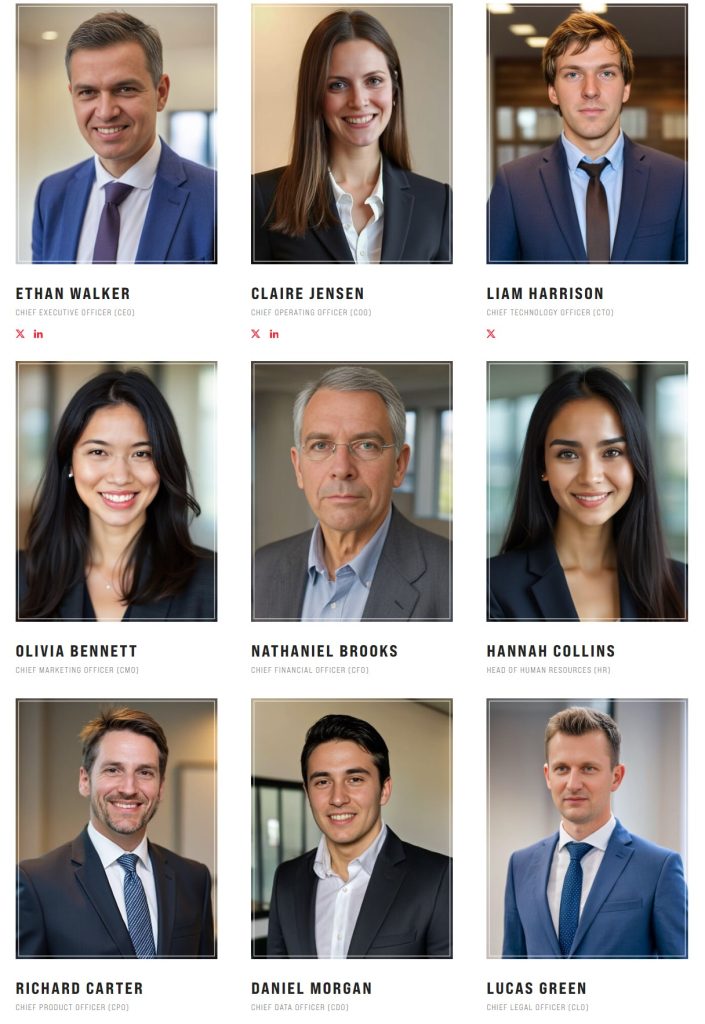

Marsses presents a leadership lineup that sounds impressive on paper:

- Ethan Walker – CEO (new LinkedIn, banned on X)

- Liam Harrison – CTO (only X, banned)

- Claire Jensen – COO (new LinkedIn and X)

Then there are a bunch of other executives with bios that read like a Netflix cast list:

- Nathaniel Brooks – CFO (LSE grad, CPA, 20 years experience)

- Hannah Collins – Head of HR (University of Toronto degree, global workforce strategy)

- Daniel Morgan – CDO (PhD from MIT, 10 years experience)

- Lucas Green – CLO (Yale Law School, corporate law specialist)

Here’s where it gets awkward.

You pointed out something that matters more than all the fancy titles:

The pictures look AI-generated.

And multiple “top execs” either have no real footprint… or their social accounts are brand new… or straight-up banned.

Now I’m not saying someone is guilty because they have a new LinkedIn.

But in the investment world, credibility isn’t optional.

If you’re asking people to stake money, route funds, or trust your “protection” systems, then your leadership shouldn’t look like:

- a stock photo pack

- an AI headshot generator demo

- or a cast of characters who appeared yesterday and vanish tomorrow

At minimum, a legit operation usually has:

- Verifiable founders with history

- Real interviews that aren’t just marketing fluff

- Clear company registration + jurisdiction

- Transparent risk disclosures that match the product

- Audits you can actually validate (not just “trust us, audited”)

With Marsses, what we have (based on your notes) is a highly curated “trust theater” presentation and leadership that feels… manufactured.

Marsses.com Products Offered

Marsses is positioned like a “crypto earning” hub with multiple “products,” including:

1) Staking / Node Staking

Marsses claims you can “stake across 100+ best-performing validators,” with “automated rebalancing,” and “full custody with no smart contract exposure.”

That wording is doing a LOT of heavy lifting.

Because here’s the contradiction:

- If they’re delegating to validators and running a pooled model (“Deposit crypto into the pool and receive Marsses”), there’s typically some form of custody/contract/operational control happening.

- They also describe a process where users deposit into a pool and “receive Marsses,” and the pool delegates to MEV-enabled validators, auctions blockspace, and redistributes MEV.

That’s not automatically a scam. But it does require clarity:

- Where are funds held?

- Who controls the wallets?

- How do users “keep custody” while depositing into a pool?

- What exactly is “receive Marsses”? A token? An internal balance? A receipt?

2) Liquid Staking

They show rates with daily reward ranges that can look wild depending on the plan:

Examples you provided include daily reward ranges like:

- 0.48% – 0.88% ROI daily (on various assets)

Let’s translate that into human terms:

- 0.5% daily is already extremely high if it’s consistent.

- “Staking” in traditional major networks is usually measured in annualized APR, not daily numbers like a slot machine.

And then they also toss around huge claims like “trusted by 5,000,000 users worldwide.”

That’s the kind of number you expect from Binance… not from a site where executives look AI-generated.

3) Other platform features

They also push:

- “Built-in exchange” / markets

- “DePIN nodes” and “RPC endpoints”

- “Perpetual contract markets”

Again: could be real, could be marketing.

But when a site tries to be:

- a staking platform

- a liquid staking platform

- an exchange

- a DePIN network

- an RPC provider

- a perpetuals market launcher

…all at once…

…it starts to feel like a buffet designed to distract you while they walk past the part where you ask who runs the kitchen.

Marsses Compensation Plan

Yes — Marsses has an affiliate program, and it’s not small.

You shared the rank table and it’s basically built like a “serious business opportunity” ladder.

What Marsses affiliates get (based on your notes)

They pay commissions on:

- “ref. from investments”

- “ref. from income”

And the ranks scale up with “structure turnover” requirements.

A few highlights:

- BASIC: 4% from investments

- C1 ($1,000 turnover): 4.2% – 1.5% + $10 reward

- C2 ($4,000): 4.4% – 2% – 0.3% + $40 reward

- A3 ($1,000,000): 7.5% – 4% – 2% – 1% – 0.25% + $15,000 reward

- S1 ($2,000,000): 10% – 5% – 2.5% – 1.5% – 0.5% + $35,000 reward

So what’s the real product being sold here?

Because when a “staking” platform heavily incentivizes:

- recruiting,

- structure turnover,

- rank rewards,

- commissions on deposits and income,

…it starts to look less like a pure staking service and more like a network-driven funding machine.

That doesn’t automatically mean Marsses scam — but it does shift the risk profile.

It tells you what the platform really values:

Not just users staking because they love technology…

…but users bringing users… who bring users… who bring users.

Cost to Join Marsses Reviews?

Marsses promotes multiple “plans,” and the buy-in numbers are not tiny.

From what you provided, the “membership plans” include things like:

- Minimum stake starting around $25 on one plan

- Then jumps to $10,000, $50,000, $100,000 minimums on others

- Delegation periods around 300–386 days

- Commissions taken from rewards (2% / 3% / 5% etc.)

Liquid staking examples include things like staking requirements:

- 32 ETH shown in the calculator example

- 175 BNB, 370,000 POL, 590 SOL etc. in plan panels

So depending on what you choose, the cost ranges from “test deposit” to “hope you didn’t need that money this year.”

Also important: if they’re pushing long delegation periods while advertising big daily reward ranges, the first question is simple:

Can you exit smoothly, anytime, without friction?

Because “flexible withdrawals” is easy to write on a website.

It’s harder to prove when markets turn ugly and withdrawals spike.

PROS and CONS

PROS

- The site is polished and detailed (it’s not a lazy one-page template)

- They explain a staking + MEV narrative, which is at least more coherent than “AI trading bot prints money”

- They list an affiliate program openly (not hidden)

- They support many assets, which could appeal to users who want variety

CONS

- Leadership credibility looks shaky

New accounts, banned accounts, missing footprints, and AI-looking headshots are not what you want in a finance platform. - The “5,000,000 users” claim feels inflated

Massive numbers require massive evidence. Otherwise it reads like marketing fiction. - Daily ROI framing is a red flag

Staking is usually presented in APR/APY terms. Daily ROI ranges that look consistently high are often used to trigger greed, not informed decision-making. - Too many “we do everything” claims

Staking + exchange + DePIN + RPC + perpetual markets + MEV optimization + “no smart contract exposure” is a lot to believe without independent verification. - Affiliate plan is built like a recruitment engine

When commissions are based on investments/income and the rank ladder is aggressive, the platform becomes vulnerable to “new money fuels payouts” dynamics. - No clear, verifiable ownership transparency in your notes

In 2025, if a platform wants trust, it doesn’t hide the basics.

Final Verdict

So… is Marsses legit or is Marsses a scam?

Based strictly on the info you provided, Marsses looks high-risk and credibility-light.

Not because of one single thing.

But because the pattern is familiar:

- Huge claims

- Daily ROI framing

- Leadership that looks manufactured

- A deep affiliate structure focused on turnover

- And a “trust me bro” wall of technical terms

Could it be a real platform? Possibly.

But if a platform is real, it should be able to survive basic scrutiny without feeling like it was built to impress people who don’t ask questions.

My stance for readers of TheMillionaireDriveBlog.com:

Treat Marsses like a “no-proof, high-risk” platform until it proves otherwise.

And do not confuse “a nice website” with “a safe place to park money.”

If you want “passive income,” cool — but don’t outsource your brain. That’s how people end up funding someone else’s “uptime.”

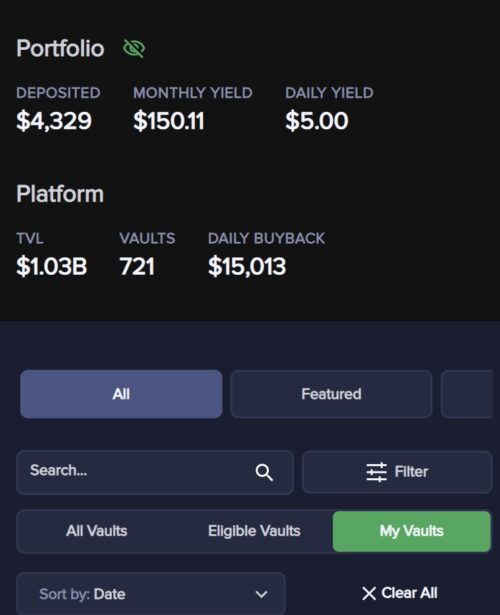

Tired of Scams? My #1 Recommendation

If you landed on this blog, you want to actually know how to make money online right? Specially with crypto.

First time ever we are offering a training where we are helping our students who are getting any where between 3% to 10% per MONTH ROI on their crypto with 100% complete control.

YOU control everything and not giving your funds away to some scamming company.

Once you learn this skill set, the sky is the limit when it comes to building wealth with crypto where you are in 100% control.

Here are some more results:

This student literally got started a few days ago and already started to make $5 per day!

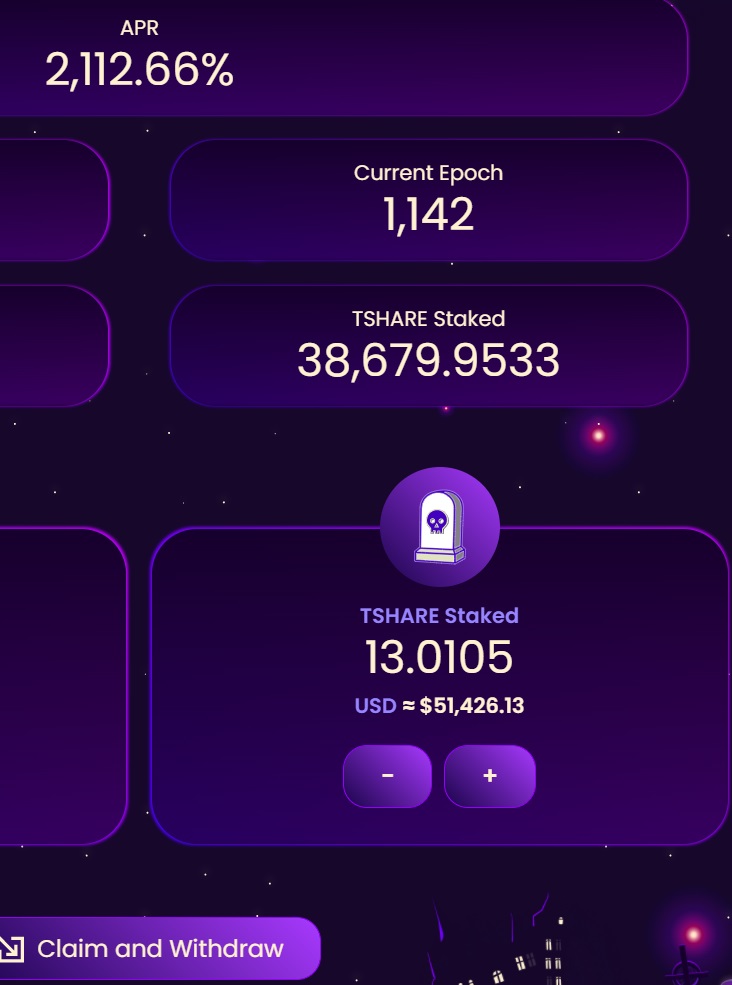

We are getting over 2000% rewards with this one per year which is LIFE changing.

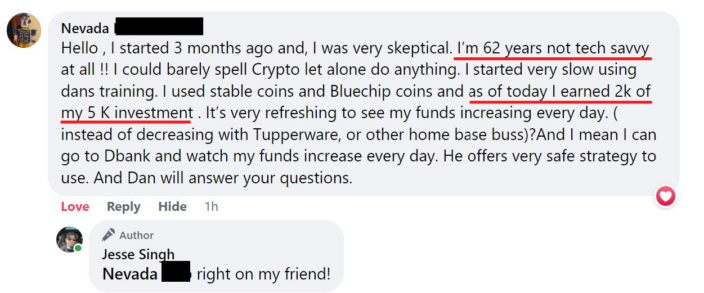

Take a look at one of our 62 year old students who profited $2,000:

Now we want to help YOU.

We have complete newbies who are just getting started and making their passive income stream online and then we have some students who have been with us for almost a year completely crushing it.

Digital Digital Economy is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Real Estate is for you.

I know you will make the right decision.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level