RAD Diversified Review – SCAM or Legit Dutch Mendenhall Opportunity?

- Coaching Program Reviews

- October 28, 2023

Welcome to Rad Diversified Review!

In today’s bustling world of real estate, RAD Diversified stands out as a beacon for aspiring investors. But what’s the story behind this company? How did it come to be, and why does it matter for you? Let’s delve deep into the journey of Dutch Mendenhall and Amy Vaughn, the pioneers behind RAD Diversified, and uncover the nuances of this unique investment opportunity.

Now before I dive in…

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

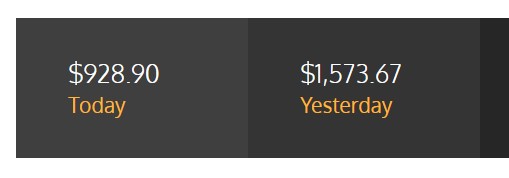

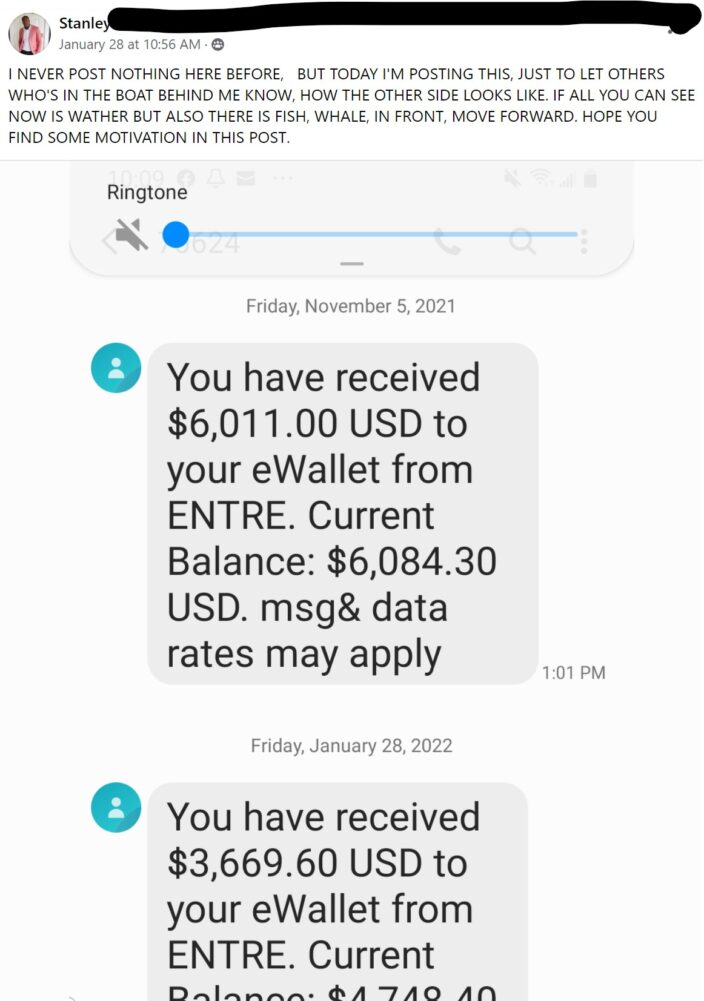

Just take a look at this:

Now I can’t guarantee you results like this but I am just showing you what is possible!

If that sounds like something you’d be interested in, check out Digital Real Estate.

Now if you want to continue, keep reading…

What is RAD Diversified Review?

RAD Diversified sprang from the minds of Dutch Mendenhall and Amy Vaughn. Originally, these two dynamic individuals were co-owners of a company focusing on tax liens. However, their paths diverged, and they began their journey into the realm of tax auction investments.

Over time, Dutch and Amy noticed a trend. Many budding real estate enthusiasts were splurging on courses, seminars, and coaching. Yet, a tiny fraction ever made the leap and actually purchased a property.

Who Runs RAD Diversified?

When Dutch delved into the reasons behind this reluctance, he found a single answer – fear. Prospective investors were riddled with concerns:

- What if the property isn’t as advertised?

- What if I underestimate the rehab expenses?

- What if hidden liens catch me off-guard?

- What if contractors vanish with my funds?

Many approached Dutch with a solution: could they partner with him instead? Dutch’s initial reaction was a firm no. He shares, “I was prospering as an investor and had a comfortable life with my family. The thought of handling other people’s finances was daunting.”

But after introspection, discussions with Amy and his spouse, and seeking spiritual guidance, Dutch felt a newfound direction. He reminisces, “We sensed this was the path God was pointing us towards.” And thus, they began, albeit not without mistakes. “Early on, we may not have always followed the legal path to the letter,” Dutch admits with a chuckle.

How Does RAD Diversified Work?

From those initial investors, many continue to trust RAD Diversified even after seven years. Their initial venture led to the birth of their first Regulation D investment fund, and soon after, two more emerged.

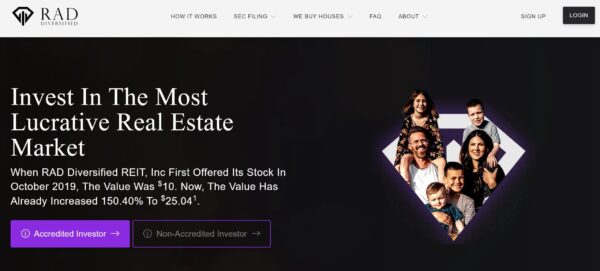

On average, Dutch says they yield returns of 15-20% annually. Although occasionally they might see a dip, the overall trajectory is positive. Their commitment is unyielding: “If you entrust us with your money, our duty is to ensure you see returns. No exceptions.”

Cost To Join RAD Diversified Reviews?

For those intrigued, Dutch highlights their enticing offer: “A mere $1,000 gets you started. You can become a partner with us.” Beyond their core REIT, RAD Diversified also boasts an ‘Inner Circle.’ Here, members join forces with the team, pooling resources for joint ventures. The deal? Both parties invest half, RAD Diversified manages operations, and then they share the profits.

And Dutch is proud to share, “In the six years since its inception, not a single Inner Circle member has faced losses.”

Final Verdict

In conclusion, my RAD Diversified review paints a promising picture. While Dutch hints at their explorations into fields like the Metaverse and cryptocurrency, he assures that their heart remains with residential real estate.

He concludes, “While we’re eager to stay ahead of an evolving economy, our core will always revolve around the daily grind of residential properties. Other ventures? They’re for the future, ensuring we’re always ahead of the curve.”

My Number 1 Recommendation

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

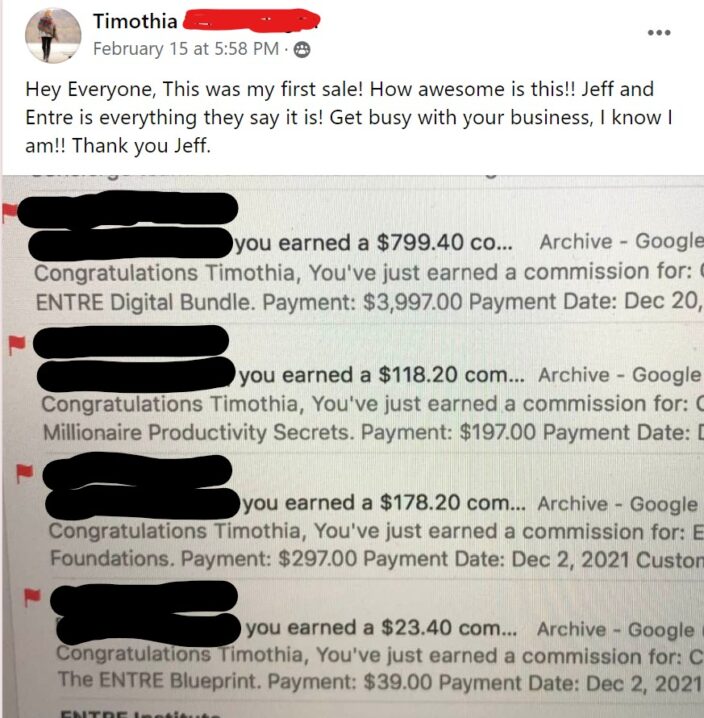

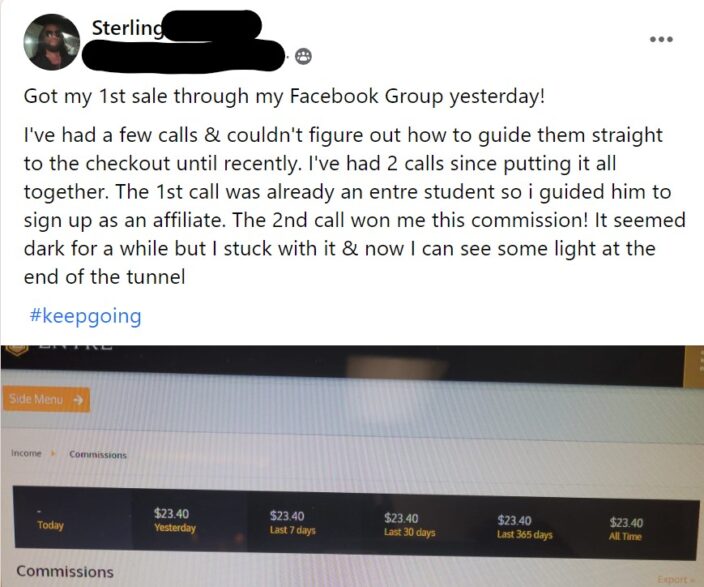

Take a look at some of the results:

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

If that sounds like something you’d be interested in, check out Digital Real Estate.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level.