Loan Officer University Review – SCAM or Legit Program?

- Course Program Reviews

- June 29, 2023

Welcome to my Loan Officer University Review!

Are you stuck in a rut with your 9 to 5, barely making ends meet, and craving for a change?

Yearning for a chance to catapult your income and live a life you’ve only ever dreamt about?

Todd Scrima, a mortgage industry veteran, asserts that the change you desire could be just a decision away.

Enter the world of Loan Officer University, a program that promises not just an income upgrade, but a complete life transformation.

Curious?

Let’s dive into our Loan Officer University review and see if it’s all that it’s chalked up to be or just another Loan Officer University scam.

Now before I do…

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

If that sounds like something you’d be interested in, check out Digital Real Estate.

Now if you want to continue, keep reading…

What is Loan Officer University Review?

Todd Scrima proposes that anyone can earn between $250k to $1 million annually, living a life of affluence and satisfaction as a mortgage loan officer.

The best part?

You don’t need any prior experience.

Having generated nearly $350 million personally in the mortgage industry, Todd has hands-on experience.

Who Runs Loan Officer University?

Todd Scrima, positioning himself as the nation’s leading mentor for loan officers, runs the show at Loan Officer University.

His reputation is soaring, hotter than a desert bonfire.

A testament to his effectiveness, over 600 of his mentees have reached the millionaire status.

How Does Loan Officer University Work?

Contrast the average American household income of about $87k, with 1.6 individuals earning, with what you could make through Loan Officer system.

After taxes, an average individual contributes around $3,200 monthly, a figure Todd Scrima believes isn’t sufficient, particularly considering work occupies about 62% of our waking hours.

That’s twice what you might spend with your partner and children.

The financial strain, Todd points out, often leads to health issues like migraines, heart disease, sleep problems, and even anxiety or depression, among others.

Todd is determined to shatter this cycle, replacing it with a more prosperous one.

Cost To Join Loan Officer University Reviews

The program’s goal is to equip you with unique, specialized skills.

Take Tracy Rickets, a former student, for instance.

Tracy used to work in a high-paying job, raising money for a college endowment fund.

Despite her impressive income, she was dissatisfied with her overpowering boss and the unappealing company culture.

Upon enrolling in Todd’s program, she swiftly mastered the art of being a loan officer, quickly replaced her old income, and was able to double that in her second year.

Currently, in her third year, she’s projected to earn $610,000.

However, the exact cost to join Loan Officer University isn’t public.

It’s kept under wraps, only disclosed during a “strategy call.” It’s worth noting that the potential rewards seem high, as demonstrated by Tracy’s experience.

Traditionally, making $250k or more per year involved starting at the bottom, tolerating minimal raises, competing for the boss’s attention, or enduring years of education to become a professional.

Todd offers an alternative: becoming a loan officer through Loan Officer University.

Final Verdict

The Loan Officer University program claims to provide a life of financial independence where worrying about money is a thing of the past.

You have the liberty to choose your schedule without any income limit.

Undoubtedly, it necessitates hard work, but the program is designed to equip you efficiently for maximum rewards.

Former student Vasiliy Korchevoy, previously earning $42,000 at a credit union, tripled his income after a year with Todd, and by the third year, he made $470,000.

“It’s real,” Todd assures, emphasizing that these are everyday individuals, without any specific advantages.

Despite Todd’s convincing testimonials, his presentation remains nebulous about the specifics of becoming a loan officer or acquiring clients.

It leaves one wondering: is Loan Officer University legit, or is it a Loan Officer University scam?

If you’re comfortable where you are, maybe a strategy call to discover the cost isn’t for you.

However, if you’re adventurous and looking for a potential income boost, it could be worth exploring Loan Officer University reviews and giving that call a shot.

My Number 1 Recommendation

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

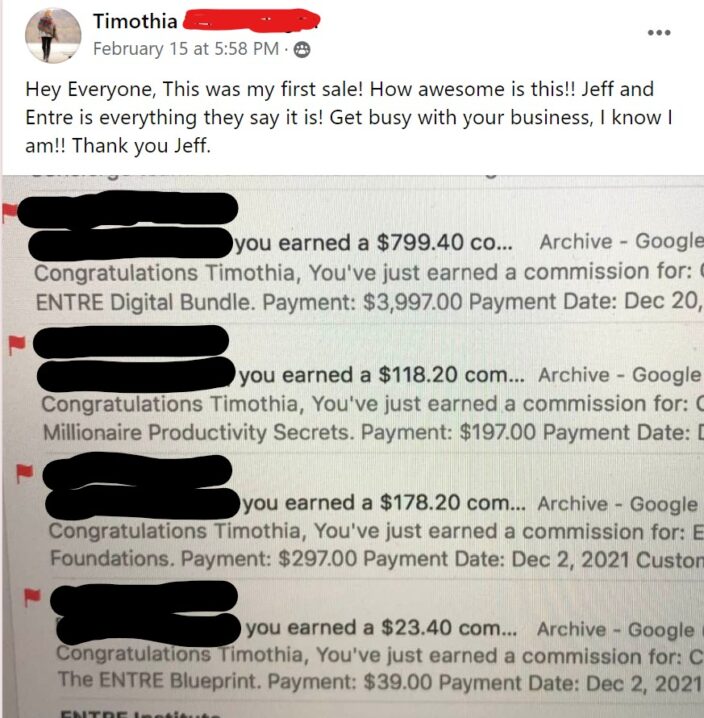

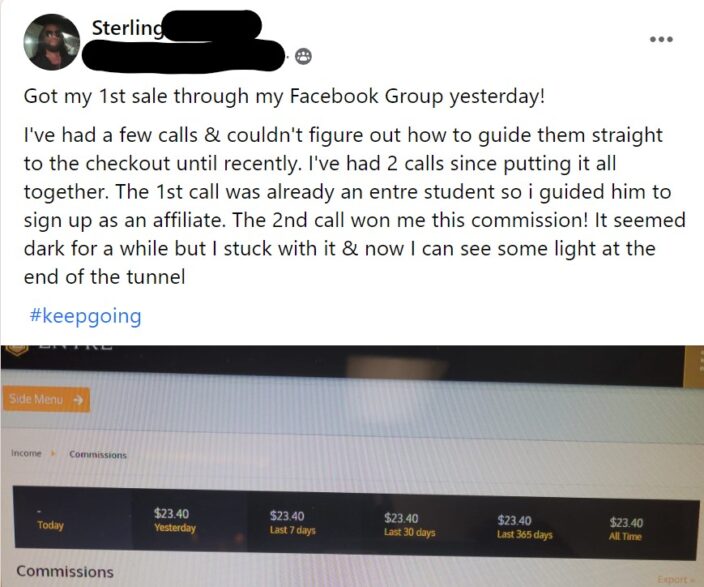

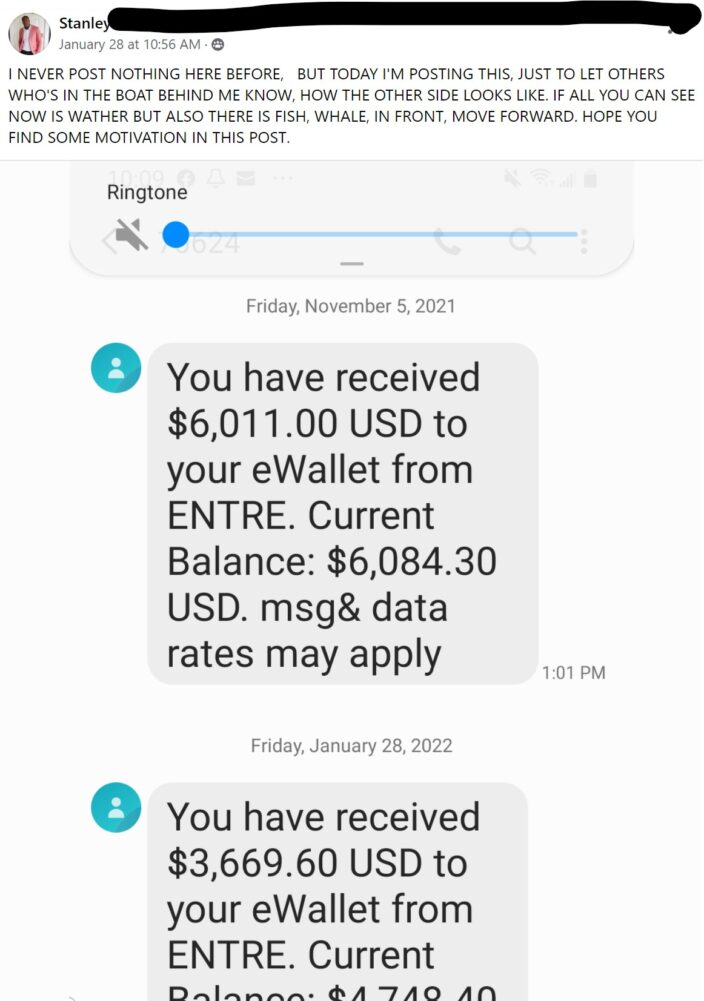

Take a look at some of the results:

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

If that sounds like something you’d be interested in, check out Digital Real Estate.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level.