Crypto ETFs Skyrocket to $100 Billion – What’s Next for the Future of Digital Asset Investing?

- Crypto NewsCryptoCurrency

- March 26, 2025

The crypto ETF market has exploded, racing toward a jaw-dropping $100 billion in assets. With Bitcoin leading the charge, industry experts are now asking: Where does the crypto ETF revolution go from here?

At the Exchange Conference in Las Vegas, Bloomberg Intelligence’s Eric Balchunas sat down with Matt Kaufman of Calamos Investments and Samir Kerbage of Hashdex to break down the rise of crypto exchange-traded funds and their next big moves. Spoiler alert: If you thought 2024 was wild, buckle up—this ride is just getting started.

Now before I dive in…

Do you want to know a 100% legit way to make an income from home with crypto?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Being on the phone all day

- Wasting hours of your life when people no-show

- Trading your time for money

- Financial stress during a bad month

- Letting someone else control your fate

- No Trading or mining

- 100% Passive rewards from crypto 12% to 200% per year

Student below is up $1000 in a week!

Remember, Lynn is brand new she just got started!

You know what is awesome about this method?

You could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing prospects and reciting the same sales pitch over and over again?

If that sounds like something you’d be interested in, check out New Digital Economy.

Now let’s get back to the article…

Crypto ETFs: The Fastest-Growing ETF Category in History

“This is the fastest-growing ETF category ever,” Balchunas declared. “It’s still only 1% of total ETF assets, but it’s taken up about 50% of my brain.”

Translation? The crypto ETF gold rush is real, and institutional investors are pouring in faster than a Bitcoin bull market.

Unprecedented Demand: Institutions Go All-In

Kerbage, a pioneer in the crypto ETF space, admitted that even seasoned industry insiders underestimated the sheer scale of demand.

“We expected huge interest, but the level of institutional activity was a shock,” he said. “Hedge funds started trading immediately, and big-time Bitcoin whales moved their positions into ETFs to take advantage of traditional financial infrastructure.”

Meanwhile, Kaufman was less surprised by the influx of money but shocked by who was investing.

“I wasn’t surprised by the asset flow, but I didn’t expect retail investors and hedge funds to be so quick on the draw,” he said. “Meanwhile, financial advisors are still figuring out their crypto strategies.”

Financial Advisors: Still on the Fence?

Even as crypto ETFs dominate headlines, many financial advisors are moving at a snail’s pace.

“About 96% of advisors say their clients ask about Bitcoin, but only 20% are actually allocating it in portfolios,” Kaufman noted. “Adoption has doubled in the past year, but there’s still plenty of room to grow.”

Kerbage likened the current state of crypto investing to the early days of the internet.

“Crypto is like the internet in the 1990s—volatile, full of promise, and misunderstood. A small allocation in a portfolio can be game-changing.”

His best analogy? “The difference between poison and medicine is the dose. Same with crypto.” In other words, a little goes a long way—especially for risk-averse investors.

Taming Bitcoin’s Volatility: The Rise of Buffered Crypto ETFs

One of the biggest concerns about crypto ETFs is their notorious volatility—because, let’s be honest, Bitcoin isn’t exactly stable.

To counter this, Calamos Investments offers buffered crypto ETFs—products that cap downside risk while still allowing for potential upside.

“Bitcoin’s returns look like a smile—big ups, big downs,” Kaufman explained. “Our products let investors choose how much they put at risk.”

Balchunas dubbed this strategy “Bitcoin with bubble wrap”—making it more appealing to investors who want exposure to digital assets but fear the infamous crypto rollercoaster.

Investor Psychology: The Biggest Risk in Crypto ETFs

Forget blockchain hacks or SEC regulations—Kerbage believes the biggest risk in crypto investing is human behavior.

“This is an asset class that can go up 50% in a few days,” he said. “That creates FOMO, bubbles, and crashes. Advisors need to help clients manage their emotions.”

But here’s the surprising part: Most crypto ETF investors are unfazed by short-term volatility.

“Even after 15-20% pullbacks, 95% of assets have stayed put,” Kerbage said. “These investors understand the long-term game.”

Beyond Bitcoin: The Next Wave of Crypto ETFs

While Bitcoin ETFs are dominating the market, insiders believe the next big wave will be crypto ETFs beyond Bitcoin.

“Right now, we’re seeing filings for everything—including meme coins like Trump and Melania,” Kerbage joked. “The SEC needs to define what’s in bounds.”

Though he didn’t name specific altcoins, Kerbage hinted that crypto index ETFs will likely be the long-term winners.

“Bitcoin is like email in the 90s—the first killer app, but not the final form of crypto innovation.”

Crypto Index ETFs: The Future of Digital Asset Investing?

Instead of betting on a single crypto asset, some experts believe index-based crypto ETFs—which track a basket of digital currencies—could ultimately outperform Bitcoin-only funds.

Hashdex, in partnership with Nasdaq, has already developed a strict eligibility framework for a broad crypto index called the Nasdaq Crypto Index.

“In five to ten years, we think crypto index ETFs will be more significant than single-asset ETFs,” Kerbage predicted.

Final Thoughts: The $100 Billion Milestone Is Just the Beginning

With crypto ETFs racing toward $100 billion in assets, the industry is only scratching the surface of its full potential.

While Bitcoin remains king, expect crypto index funds and buffered ETFs to play a growing role in making digital assets more accessible, diversified, and risk-adjusted.

For investors looking to ride the next crypto wave, the message is clear: Crypto ETFs aren’t just a passing trend—they’re the future of digital asset investing.

Tired of Scams? My #1 Recommendation

If you landed on this blog, you want to actually know how to make money online right? Specially with crypto.

First time ever we are offering a training where we are helping our students who are getting any where between 20% to $200% per year on their crypto with 100% complete control.

YOU control everything and not giving your funds away to some scamming company.

Once you learn this skill set, the sky is the limit when it comes to building wealth with crypto where you are in 100% control.

Here are some more results:

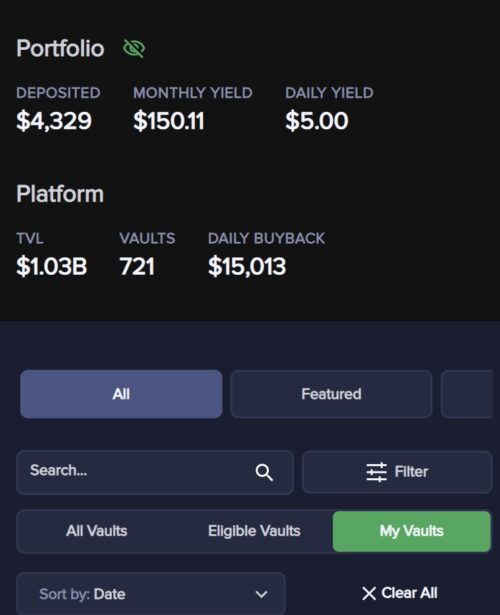

This student literally got started a few days ago and already started to make $5 per day!

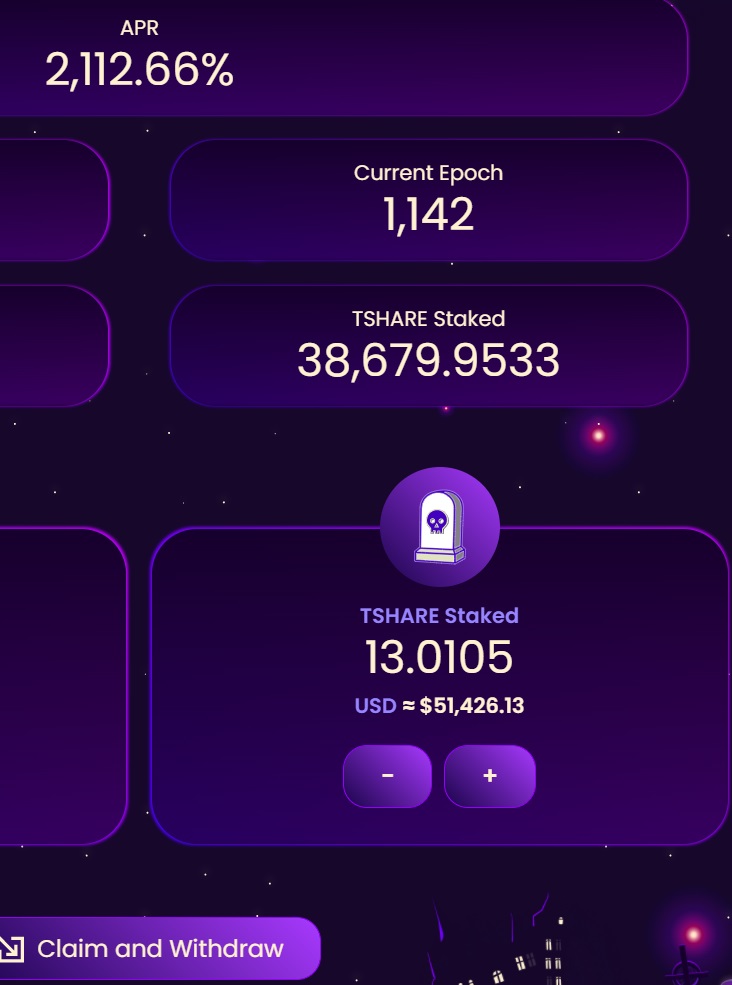

We are getting over 2000% rewards with this one per year which is LIFE changing.

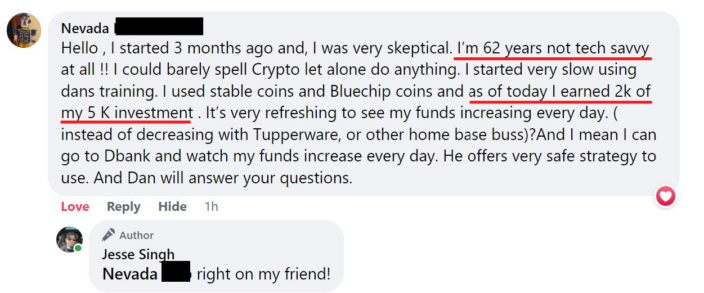

Take a look at one of our 62 year old students who profited $2,000:

Now we want to help YOU.

We have complete newbies who are just getting started and making their passive income stream online and then we have some students who have been with us for almost a year completely crushing it.

Digital Digital Economy is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Real Estate is for you.

I know you will make the right decision.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level.