Karlton Dennis Review – SCAM or Legit Tax Alchemist?

- Influencer Reviews

- November 2, 2023

Welcome to my Karlton Dennis Review!

In the vast realm of tax planning and finance, certain names stand out, and Karlton Dennis is one such name. A blend of expertise and innovation, he’s changing the game of personal finance and taxation. Dive in to uncover the artistry behind his tax-saving strategies and see how they could reshape your financial landscape.

Now before I dive in, if you want to learn how I went from being a car mechanic to building a 7 figure business online, read this…

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

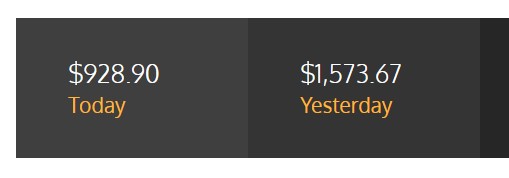

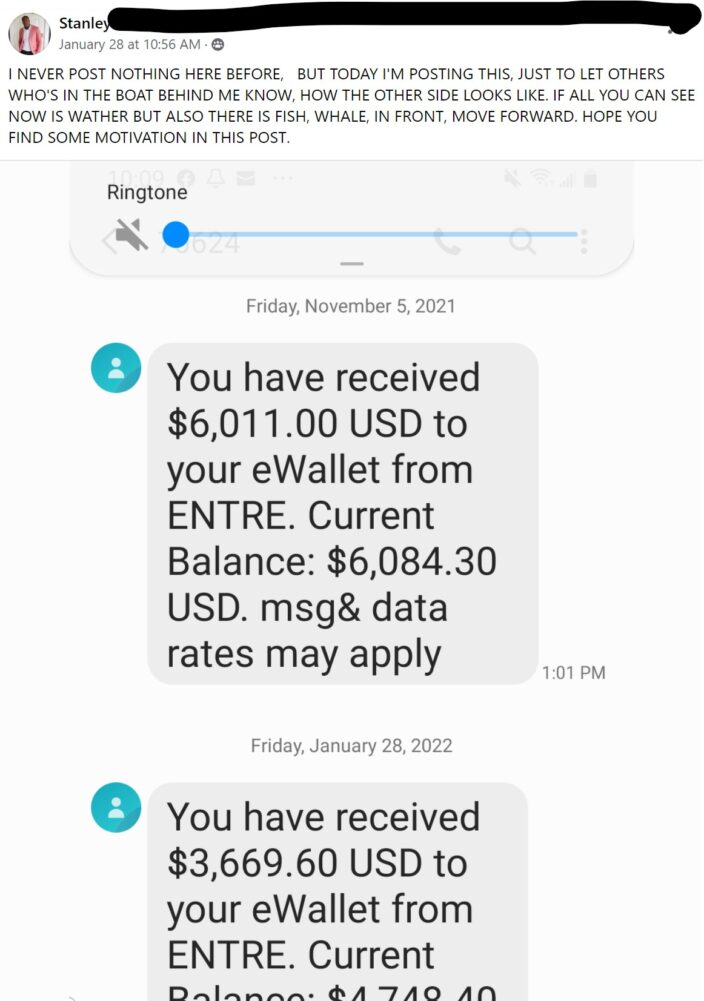

Just take a look at this:

Now I can’t guarantee you results like this but I am just showing you what is possible!

If that sounds like something you’d be interested in, check out Digital Real Estate.

Now if you want to continue, keep reading…

Who is Karlton Dennis Review?

Karlton Dennis is a recognized enrolled agent, which, interestingly, holds a different standing than a traditional CPA. Karlton, who likes to call himself the “Tax Magician,” emphasizes the importance of smart tax management to save more of your hard-earned money every year.

What Does Karlton Dennis Offer?

To begin with, Karlton emphasizes the significance of collaborating with two experts: a tax accountant and a tax specialist. The latter is often overlooked by many business people. As a result, they settle for someone adept at tax filing but may miss out on tax-saving opportunities.

Karlton elaborates, “A tax specialist delves deep into tax laws, guiding you on maximizing these laws to your benefit.”

On the other hand, “a tax accountant’s primary role is to know the regulations for submitting your tax details. Their focus is more on compliance, ensuring your taxes are filed correctly. But tax planning discussions may be limited.”

“Your tax specialist,” Karlton adds, “engages you in meaningful discussions. This includes your spending habits, family financial structure, residence preferences, investment plans, and more. They act as a trusted advisor, steering you towards sound financial decisions.”

So, what’s the second piece of advice from Karlton?

Convert your personal costs into business expenses. Items like your mobile phone, vehicle, or even your rent could potentially be deducted if done correctly. Karlton mentions a particular tax code, section 162(A), highlighting the need for a tax expert to guide through such intricacies.

Cost To Join Karlton Dennis Reviews

While not explicitly stated in the original content, it’s implied that to gain these insights and more, individuals might need to join Karlton’s Tax Alchemy Program or seek consultation through Kar-la Dennis & Associates, Inc.

Final Verdict

The third step in Karlton’s strategy is timely implementation, preferably by December 31st. Procrastinating until the next year, like most do, might close many beneficial doors.

The fourth step revolves around maximizing both tax deductions and deferrals. Karlton states, “Many are aware of tax deductions, where expenses reduce taxable income. But tax deferrals, which allow you to postpone certain tax payments, are underutilized. It could be as simple as setting up retirement accounts to control the money that would otherwise go to taxes.”

Lastly, the fifth step is the adoption of a tax elimination strategy, with real estate being a popular choice. Investing in long-term rental properties can offer depreciation benefits.

If you’re keen to expand your knowledge on these strategies, Karlton Dennis’s Tax Alchemy Program is a good starting point. Additionally, his role as the Business Director at Kar-la Dennis & Associates, Inc. further solidifies his expertise in the domain.

On a lighter note, isn’t it amusing how Karlton’s name seems to hint at a resemblance to a famous TV character, Carlton Banks?

My Number 1 Recommendation

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

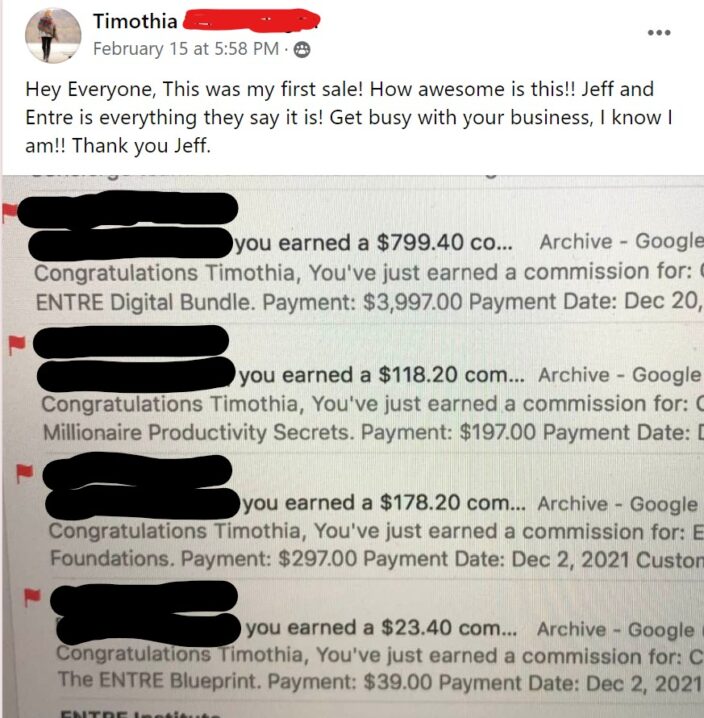

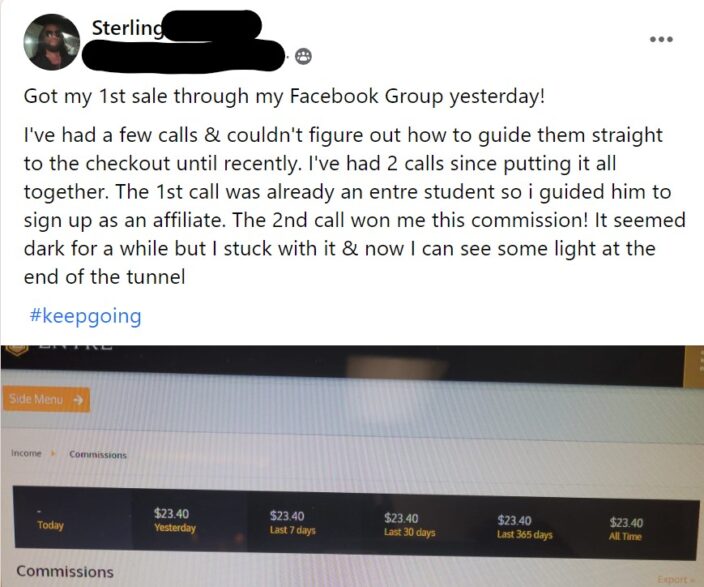

Take a look at some of the results:

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

If that sounds like something you’d be interested in, check out Digital Real Estate.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level