ETF Supply Shock or Marketing Myth? The Real Story Behind XRP’s $12 Price Prediction

- Crypto NewsCryptoCurrency

- October 23, 2025

It’s that time again — XRP is trending, crypto Twitter is melting down, and analysts are tossing out double-digit predictions like confetti.

This round’s headline grabber? A so-called “inevitable supply shock” that’s supposed to send XRP rocketing to $12 by 2025 once exchange-traded funds (ETFs) hit the market.

Sounds exciting. But let’s separate fact from fairy dust.

Now before I get into this…

Do you want to know a 100% legit way to make an income from home with crypto?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Being on the phone all day

- Wasting hours of your life when people no-show

- Trading your time for money

- Financial stress during a bad month

- Letting someone else control your fate

- No Trading or mining

- 100% Passive rewards from crypto 12% to 200% per year

Student below is up $1000 in a week!

Remember, Lynn is brand new she just got started!

You know what is awesome about this method?

You could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing prospects and reciting the same sales pitch over and over again?

If that sounds like something you’d be interested in, check out New Digital Economy.

Now back to the XRP news…

The Analyst Behind the Hype

Crypto commentator Zach Rector, followed by nearly 90 000 users on X, believes ETF demand will drain XRP’s circulating supply faster than retail traders can refresh CoinMarketCap.

In a livestream earlier this week, he said:

“When these ETFs go live, we’re going to see inflows. With conservative assumptions, XRP’s headed to a much higher price — the supply shock is inevitable.”

His forecast: $5 to $12 by December 2025.

Ambitious? Absolutely. Impossible? Not entirely — if the ETF narrative actually materializes.

The Problem With “Inevitable”

Crypto history is littered with “inevitable” events that aged like milk.

Bitcoin’s spot ETFs were also billed as world-changing — and yes, they moved markets, until reality showed up wearing a correction.

XRP’s situation is even trickier:

Regulatory baggage ✔️

Liquidity concerns ✔️

Institutional hesitation ✔️

Until Wall Street stops treating XRP like the rebellious cousin at Thanksgiving dinner, an ETF approval isn’t guaranteed — and neither is that “shock.”

What the Charts Actually Say

Right now XRP trades near $2.40, recovering from its early-October dip to $1.80.

Support at $1.80 held like a champ, showing buyers still exist below two bucks.

But the real test sits at $3.40 — break that, and bulls finally get something to tweet about.

If momentum holds, $5.50 becomes the next magnet.

If it doesn’t, we’re headed back to the support-group channel where bag-holders quote motivational memes about “long-term conviction.”

The ETF Domino Theory

Rector’s logic is straightforward:

ETFs = locked-up tokens.

Locked-up tokens = less supply.

Less supply + demand = moon.

It worked (briefly) for BTC.

And to be fair, institutional hoarding can create serious bottlenecks in liquid markets.

But every “shock” requires real inflows — not just Twitter threads and PowerPoint math.

Behind the Scenes: Whale Whispering

On-chain data hints that corporate wallets have been quietly stacking XRP for months.

Roughly $1.7 billion worth sits in newly created treasury addresses.

That’s bullish — but it’s also speculative.

Institutions accumulate options, not just optimism. If ETF delays stretch into 2026, that accumulation could flip to distribution faster than you can say “exit liquidity.”

Narrative vs Numbers

The beauty — and curse — of crypto is its marketing.

“Supply shock” sounds scientific. In reality, it’s code for “we hope demand outweighs bagholders.”

Without concrete filings, approval timelines, or fund inflows, this entire story rests on potential.

And potential doesn’t pay the bills.

Still, sentiment matters. Even a rumor can light a fire under traders desperate for the next 2021-style run.

Why the $12 Dream Persists

Because XRP has one thing most altcoins lost: a loyal cult of believers.

To them, $12 isn’t a stretch — it’s overdue.

They’ve survived delistings, lawsuits, and more FUD than a federal hearing.

Now, with whispers of institutional adoption, the dream feels tangible again.

And in crypto, conviction + narrative = price movement — at least until the chart says otherwise.

Final Verdict

So, will ETFs cause an XRP supply shock? Maybe. But calling it inevitable is like saying your next date with volatility will go smoothly.

If ETFs launch and real capital floods in, Rector’s $12 target could age beautifully.

If not, it’s just another headline built for engagement — and you’re reading it.

Either way, XRP isn’t leaving the conversation anytime soon.

Whether it’s a revolution or rerun depends on what happens when hype meets the regulator’s pen.

For now, enjoy the show — and remember: in crypto, “inevitable” usually means “eventually disappointing.”

Tired of Crypto Scams? My #1 Recommendation

If you landed on this blog, you want to actually know how to make money online right? Specially with crypto.

First time ever we are offering a training where we are helping our students who are getting any where between 20% to $200% per year on their crypto with 100% complete control.

YOU control everything and not giving your funds away to some scamming company.

Once you learn this skill set, the sky is the limit when it comes to building wealth with crypto where you are in 100% control.

Here are some more results:

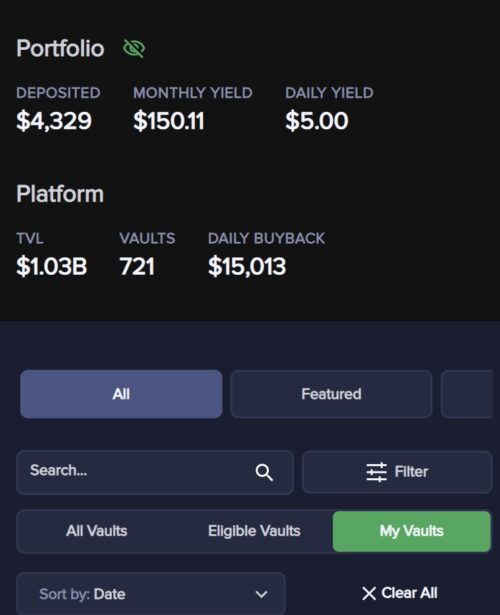

This student literally got started a few days ago and already started to make $5 per day!

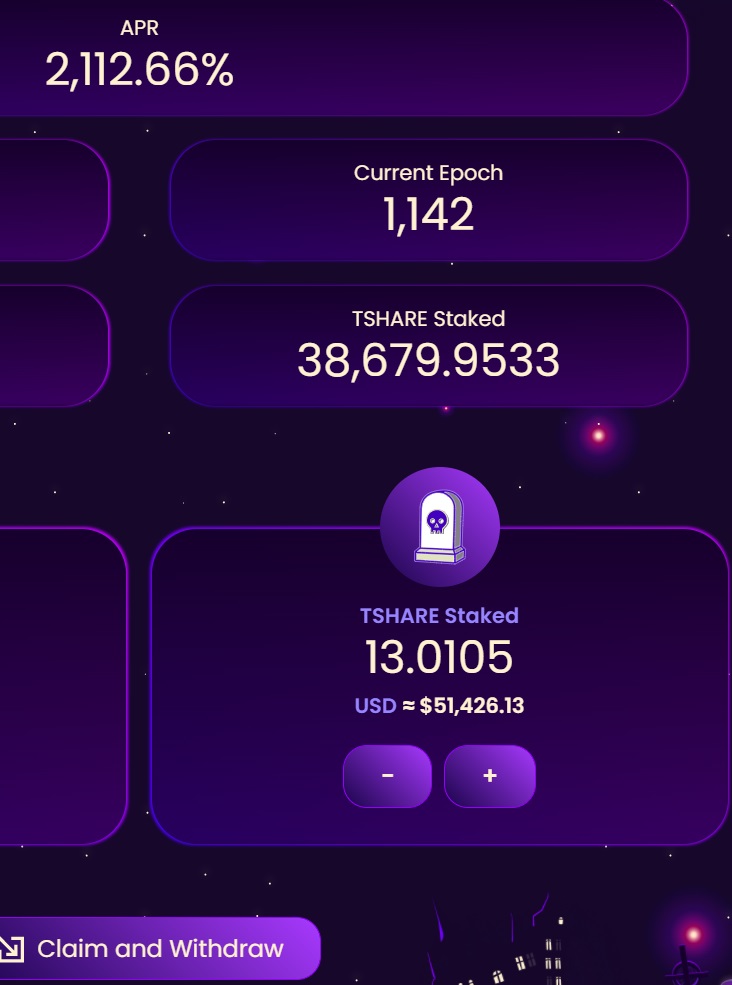

We are getting over 2000% rewards with this one per year which is LIFE changing.

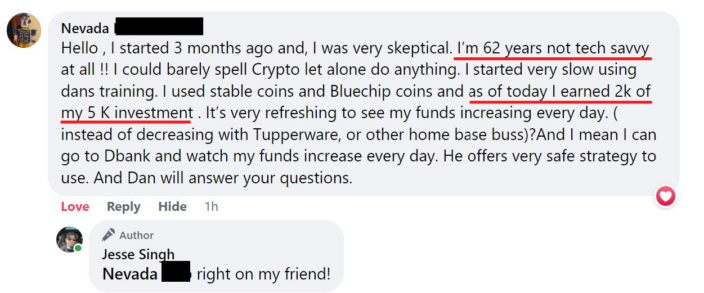

Take a look at one of our 62 year old students who profited $2,000:

Now we want to help YOU.

We have complete newbies who are just getting started and making their passive income stream online and then we have some students who have been with us for almost a year completely crushing it.

Digital Digital Economy is the #1 online business model for those just starting out.

Whether you’ve never made a dollar online, or you’ve been in this space for a while but never really “made it,” Digital Real Estate is for you.

I know you will make the right decision.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level