TranzactCard Pauses DBO Sign-ups & Card Referrals

- MLM News

- February 4, 2024

In a surprising move, TranzactCard has announced a temporary halt in the recruitment of new Digital Branch Owners (DBOs) and the referral of new “retail” card members. This decision, outlined in a detailed notice on their official website, has sparked a wave of speculation among industry observers and participants alike.

Now before I dive in, if you want to learn how I went from being a car mechanic to building a 7 figure business online, read this:

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

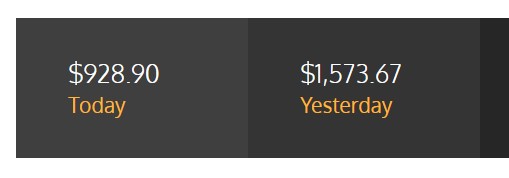

Just take a look at this:

Now I can’t guarantee you results like this but I am just showing you what is possible!

If that sounds like something you’d be interested in, check out Digital Real Estate.

Now if you want to continue, keep reading…

Official Reason for Suspension

The company cites the launch of “a complementary suite of products and services” in the upcoming week as the reason for this suspension. At first glance, this rationale appears somewhat flimsy. Typically, the process of adding or updating product offerings does not necessitate a freeze in recruitment or referral activities, even in platforms not known for their technical sophistication. This has led to questions about the true motive behind the suspension.

Speculation on Underlying Causes

The vague nature of the term “complementary suite” has fueled suspicions that TranzactCard is frantically addressing unforeseen delays, potentially linked to unreported banking issues. The lack of updates following the Bangor Bank announcement in December 2023, coupled with a conspicuous absence of progress reports, suggests that the company may be employing stalling tactics.

Recruitment and Referral Standstill

The cessation of recruitment and referral processes raises further questions, particularly in light of the absence of any significant developments that would justify such a measure. Observers are left to wonder whether the upcoming week will shed light on the connection between the new product suite and the current recruitment/referral freeze.

Potential Impact of Data Breach

Another possible explanation for this strategic pause is the recent revelation of a data breach affecting approximately 32,000 TranzactCard accounts. This incident, which has not been formally acknowledged by TranzactCard to its DBOs or members, represents a serious lapse in protocol as per Federal Trade Commission (FTC) guidelines. These regulations mandate prompt notification to affected individuals in the event of a data breach, a step TranzactCard appears to have bypassed.

Regulatory Implications

The failure to disclose such a significant security breach could invite regulatory scrutiny. Drawing parallels to past incidents, such as the 2018 SEC fine levied against Altaba (formerly Yahoo!) for similar omissions, TranzactCard could face severe penalties for its lack of transparency. This context makes the quiet attempt to address the breach a more plausible reason for halting recruitment and referral than the addition of new products or services.

Conclusion

As TranzactCard navigates through these turbulent waters, the coming weeks are critical. The company’s ability to transparently address the speculated banking issues, effectively launch its promised suite of products and services, and, most importantly, manage the fallout from the alleged data breach, will be closely watched. The decisions made now could have lasting impacts on TranzactCard’s reputation, regulatory standing, and overall customer trust.

My Number 1 Recommendation

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

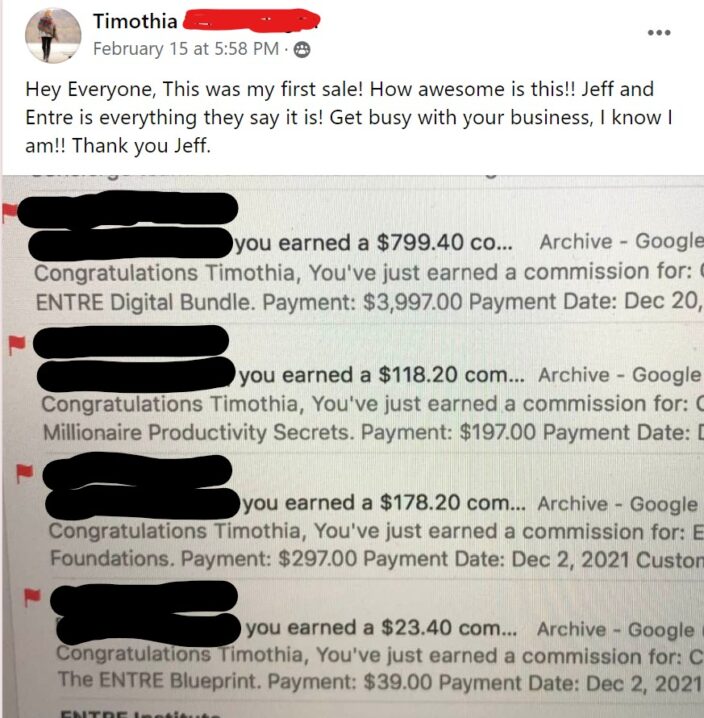

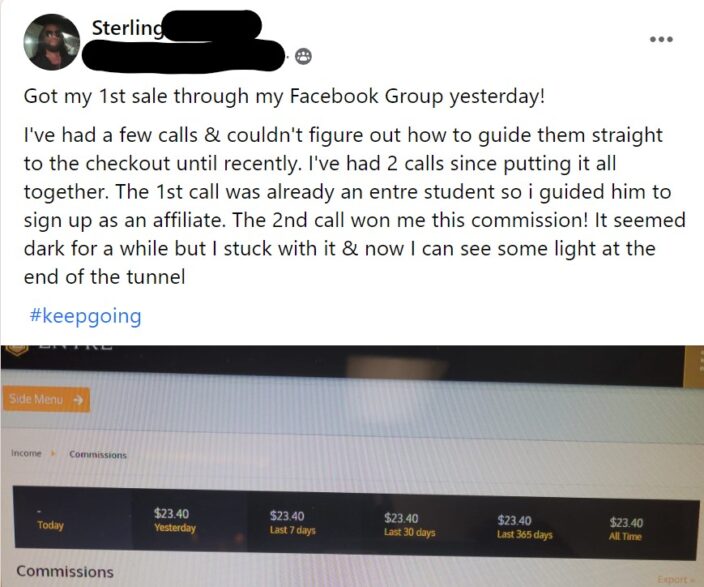

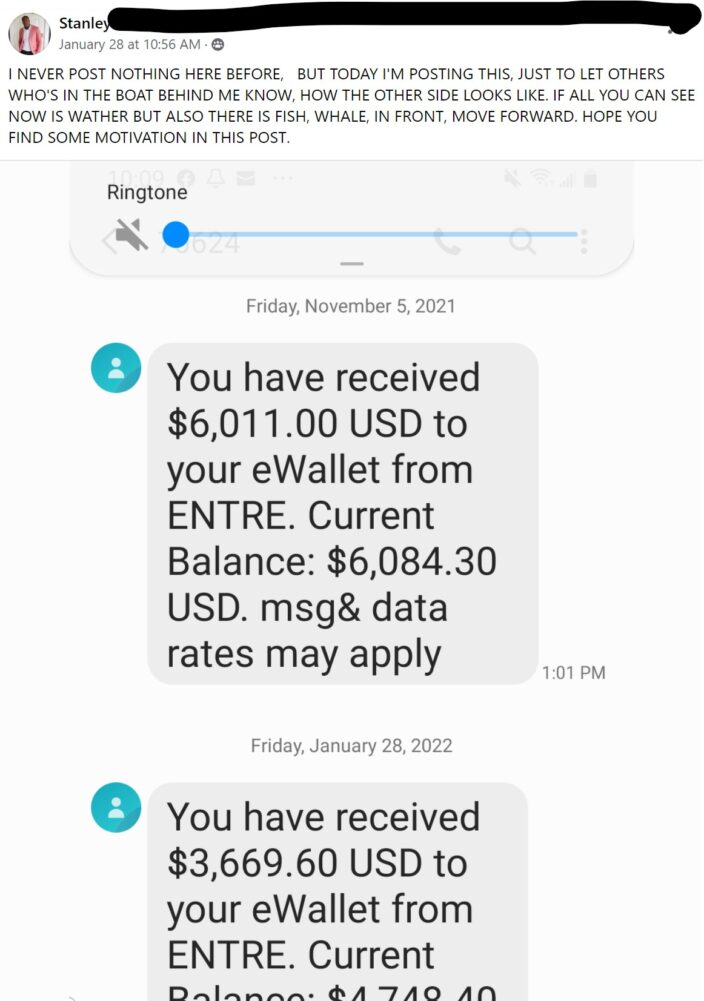

Take a look at some of the results:

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

If that sounds like something you’d be interested in, check out Digital Real Estate.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level