FinMore’s Debut: From TranzactCard’s Ashes

- MLM News

- February 4, 2024

In a tale as old as time within the tech and financial industries, the latest chapter of Richard Smith’s TranzactCard narrative has concluded in a familiar fashion: collapse. This event marks yet another pivot point in the ongoing saga of digital financial platforms grappling with the challenges of innovation, security, and market demands. Amidst the rubble of TranzactCard’s ambitious yet ultimately unsustainable model, a phoenix aims to rise in the form of FinMore—a reboot announced in the aftermath of halted Digital Branch Owner (DBO) recruitment and member referrals. This transition to FinMore is not merely a name change but a strategic overhaul intended to navigate the company through turbulent waters. However, beneath the surface of this rebranding lies a complex web of new fees, altered identities, and a quest for survival in the competitive fintech landscape.

Now before I dive in, if you want to learn how I went from being a car mechanic to building a 7 figure business online, read this:

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

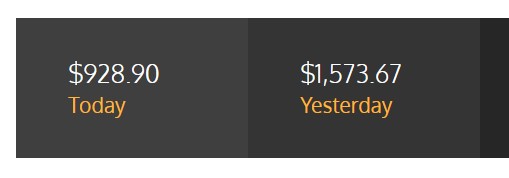

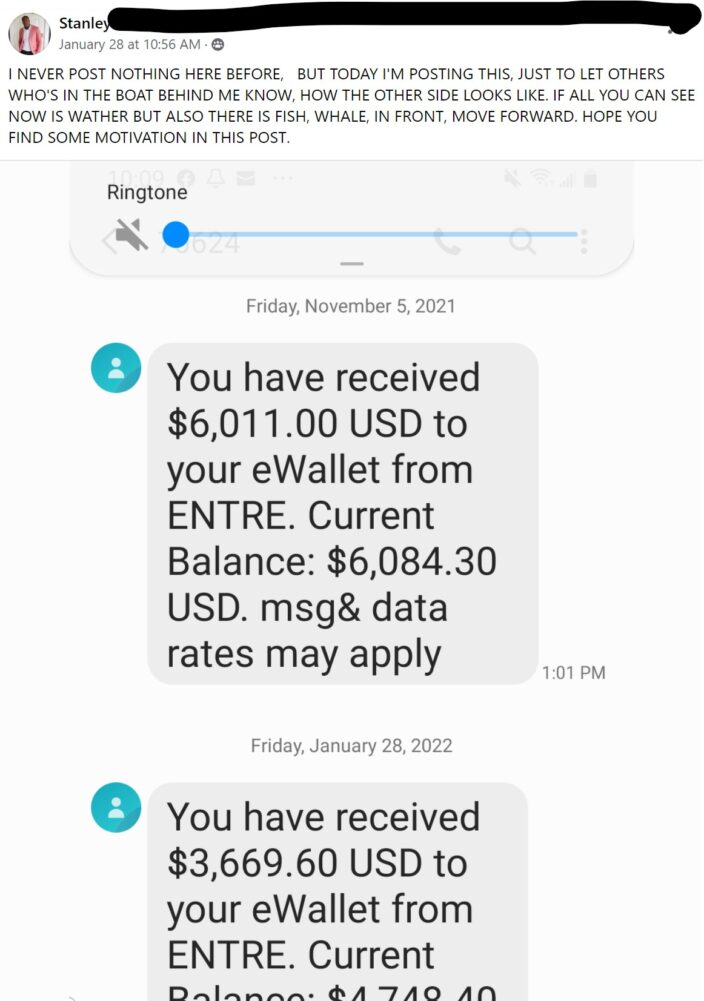

Just take a look at this:

Now I can’t guarantee you results like this but I am just showing you what is possible!

If that sounds like something you’d be interested in, check out Digital Real Estate.

Now if you want to continue, keep reading…

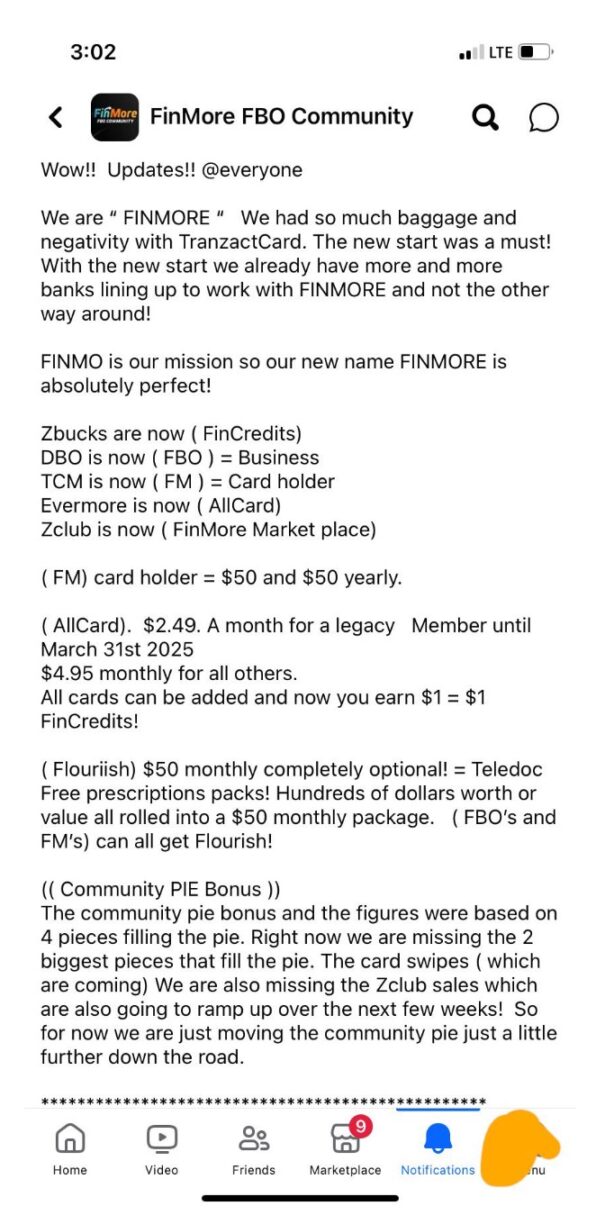

Announcement of the FinMore Reboot

In an unexpected twist, the FinMore reboot was unveiled during a corporate call, signaling a fresh direction following the cessation of DBO recruitment and member referral activities. Ostensibly a cosmetic makeover, FinMore’s introduction has been met with mixed reactions, primarily due to its revamped fee structure and redefined roles:

- TranzactCard DBO → FinMore Business Owner (FBO)

- TranzactCard Member (retail customer) → Finmore Cardholder

- ZClub → FinMore Market Place

- ZBucks → FinCredits

New Fee Structure Introduced

With the debut of FinMore, a new pricing model has been implemented, drawing a clear line between “legacy” TranzactCard members and new FinMore cardholders. The former group is offered a temporary grace period with reduced access fees until March 2025, highlighting a tiered commitment to existing users while navigating the transition.

Overview of FinMore’s Offered Services

FinMore’s service offerings, branded under the “Flourish” umbrella, promise a suite of discount services through partnerships with undisclosed third-parties. This array of services spans health, wellness, and financial management, aiming to provide a holistic approach to member benefits.

Flourish Health and Wellness

The health and wellness segment includes a comprehensive list of programs and discounts, from telemedicine to fitness and nutrition programs, catering to a wide array of member needs.

Flourish Decision Maker

This segment focuses on financial wellbeing, offering tools for budget management, finance tracking, and overspending correction, indicating a shift towards empowering members with financial literacy and control.

Questioning FinMore’s Value Proposition

The introduction of Flourish, with its additional $50 monthly fee, raises pivotal questions about the tangible value FinMore delivers to its members, especially in comparison to the legacy offerings of TranzactCard.

Adjustments in Pricing and Commissions

The restructuring extends to the MLM framework, where FinMore aims to simplify and reduce the financial barriers for new recruits and retail customers, potentially broadening its appeal but also redefining the incentive models for engagement and growth within the platform.

The Attempt to Distance from Richard Smith

A notable undercurrent in the transition to FinMore is the deliberate effort to distance the new entity from the controversies and challenges associated with Richard Smith, the founder of TranzactCard. This strategic move suggests a desire for a clean slate, though the effectiveness of this disassociation remains to be seen.

Unresolved Issues and Corporate Silence

Despite the forward-looking stance of FinMore, lingering questions about the fate of investments made in TranzactCard and the unaddressed data breach involving 32,000 accounts cast a long shadow over the new venture. The silence from corporate channels on these critical issues adds to the uncertainty and speculation surrounding the company’s future.

Conclusion:

The transition from TranzactCard to FinMore represents a pivotal moment in the company’s history, fraught with challenges but also brimming with potential. As the fintech landscape continues to evolve at a breakneck pace, FinMore’s ability to address past mistakes, foster transparency, and offer genuine value will be crucial determinants of its success or failure. The coming months will reveal whether this rebranding can truly distance the company from its troubled past or if it’s merely a superficial change in a cycle of repeated challenges.

My Number 1 Recommendation

Do you want to know a 100% legit way to make an income from home?

What if you could build a passive income stream that’s actually passive?

An income stream that doesn’t require:

- Inventory

- Selling to friends and family

- Selling to strangers

- Recruiting people

- Dealing with questionable products that weigh on your conscience

An income stream that brings in consistent revenues every single month (from a couple thousand dollars to well over $10,000)?

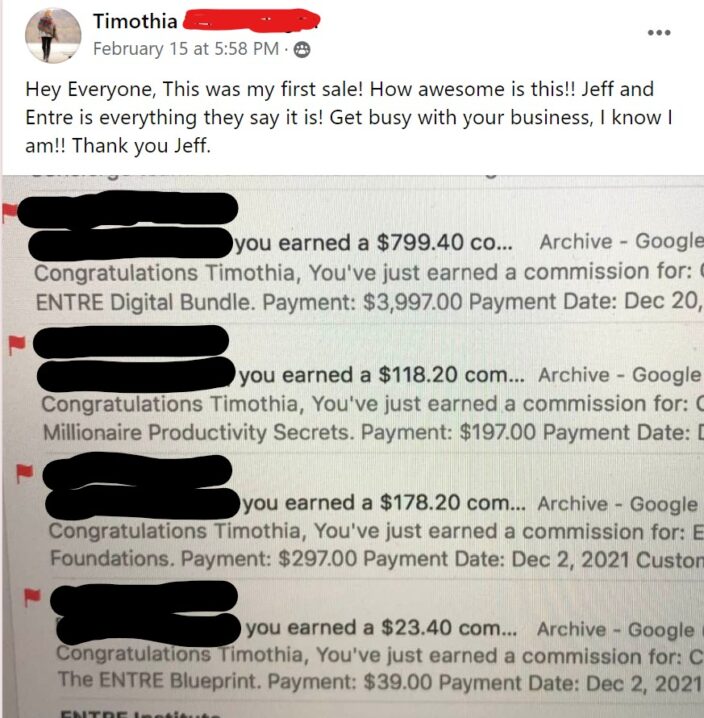

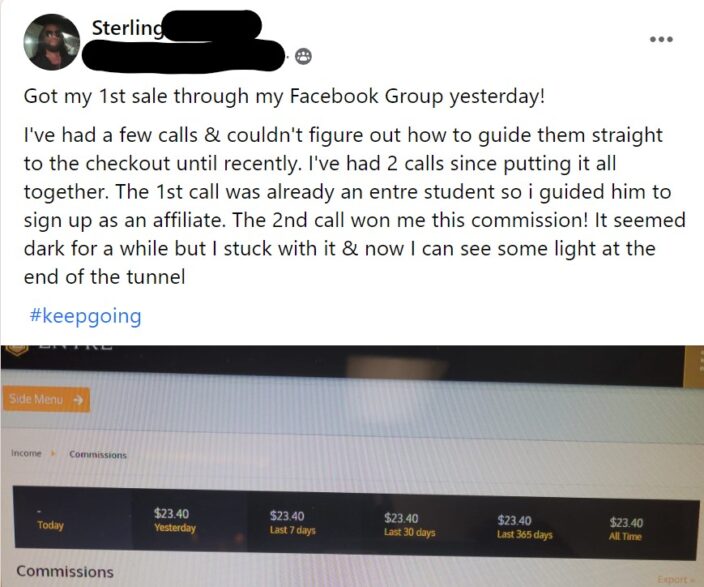

Take a look at some of the results:

An income stream you could actually build in your spare time, and grow as large or as small as you want to, without having to spend hours a day chasing, selling, or managing anything?

If that sounds like something you’d be interested in, check out Digital Real Estate.

Follow me on Social media below:

Subscribe To My YouTube Channel Here.

See you at the top,

-Jesse Singh

P.S. If you are tired of failing ANY business, click here and check this out to take your game to the next level